Online grocery shopping – a trend that is here to stay

- 02 June 2021

When thinking about e-commerce growth, one usually has in mind numerous offers for electronic products, cosmetics, apparel, etc. available online. Until recently, e-grocery wasn’t the first thought – in 2018, even in the US, as many as 84% of respondents said they were never buying groceries online, according to the Gallup poll.

When thinking about e-commerce growth, one usually has in mind numerous offers for electronic products, cosmetics, apparel, etc. available online. Until recently, e-grocery wasn’t the first thought – in 2018, even in the US, as many as 84% of respondents said they were never buying groceries online, according to the Gallup poll.

The COVID pandemic and the tendency of staying at home has made a big change in this regard – the PwC’s “Global Consumer Insights Service” states that 63% of customers are buying more groceries online than before the social distancing.

E-grocery is a trend that is about to stay, and that is worth monitoring. What are the most relevant trends and challenges? What are the biggest companies operating in the e-grocery business and how do they stand out?

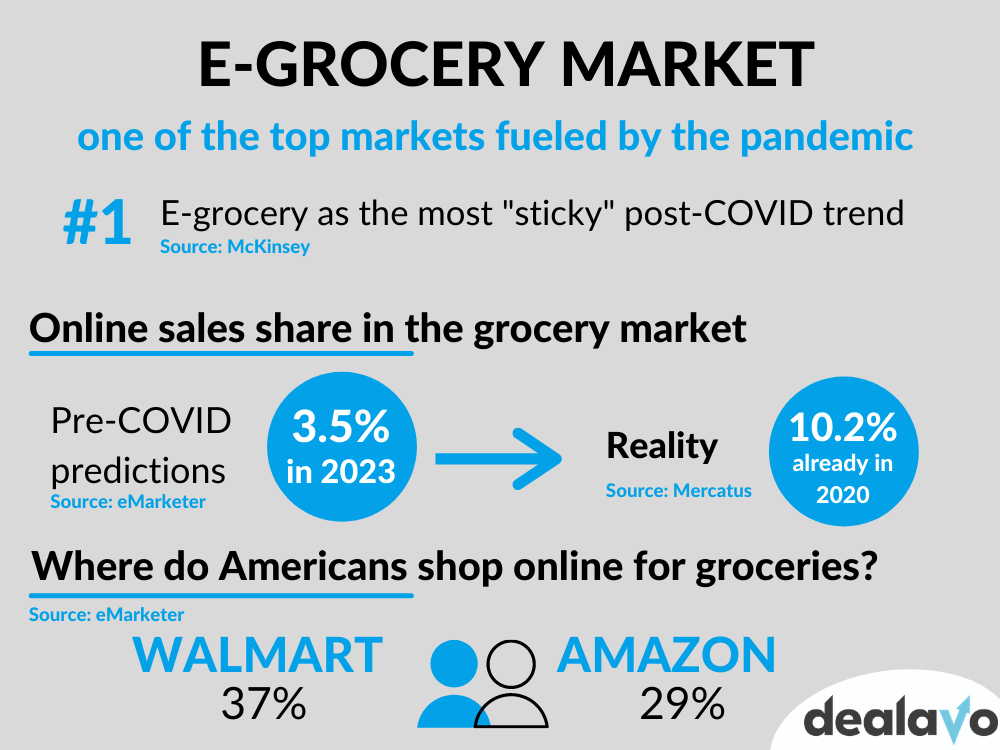

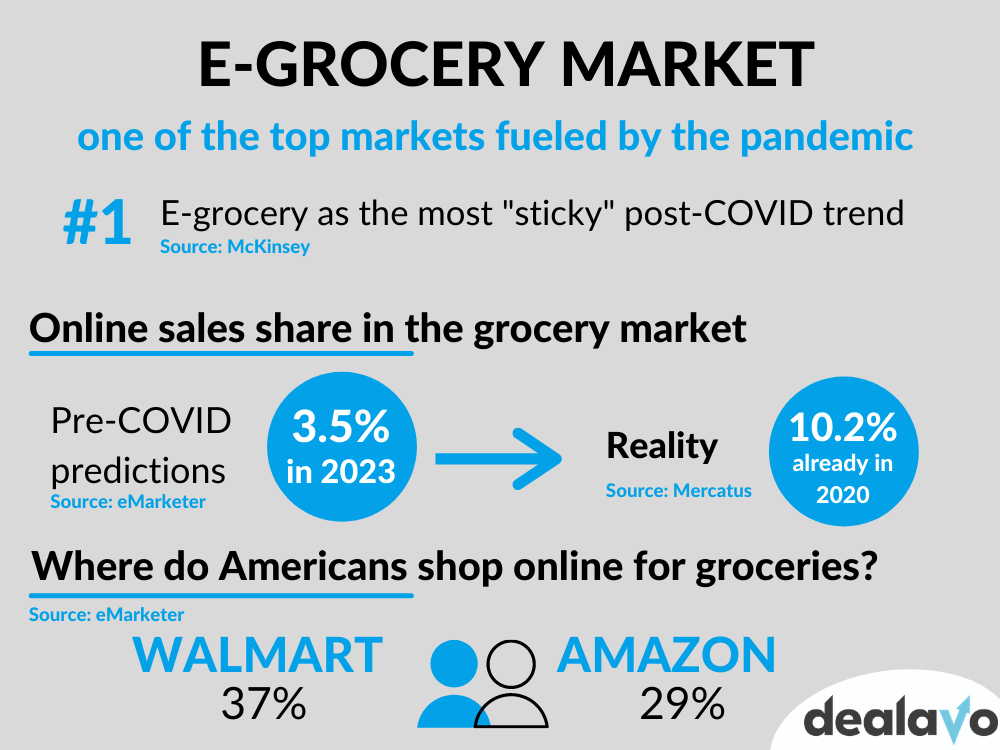

Acceleration of online grocery shopping as the most “sticky” post-COVID trend

Within the last year, all of us have heard the phrase “COVID will have a lasting impact on our lives” several times. However, will it indeed have a lasting influence on almost all the industries? Which will be the long-lasting trends and which activities and actions were implemented only for a short term?

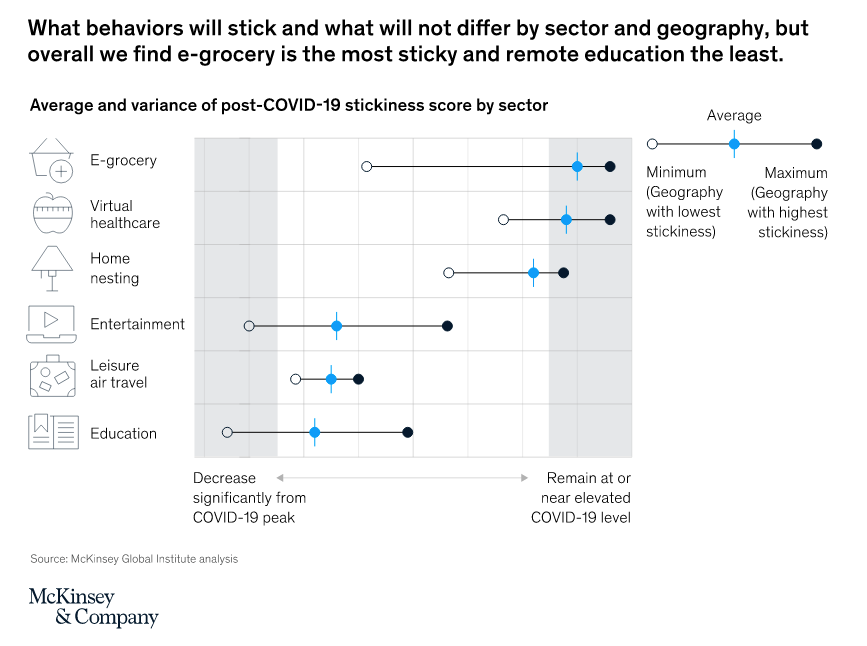

McKinsey has tried to answer this question in the report “The consumer demand recovery and lasting effects of COVID-19”. What are the results?

It turns out that e-grocery shopping was selected as the most “sticky” long-lasting trend from the list (which included, among others, virtual healthcare visits, home nesting, remote learning, etc.):

It means that buying food online should stay with us. However, what is highlighted in the report, not all the companies from the industry could achieve full success. The determinants of a quick and effective reaction were established delivery capabilities and relationships. It can be well presented looking at the key determinants of success in different countries:

China, the United Kingdom, the United States, and, to a degree, France, had grocery players with an established, albeit low-penetration, online presence that were relatively well prepared for the explosion of e-grocery. These countries also had higher e-commerce penetration and had strong delivery networks. Together, this enabled grocers to rapidly offer a variety of options, be it BOPIS (buy online, pick up in store) versus delivery or third party versus grocer-hosted, at the same time integrating with payment platforms that provided more reliable, timely, and tailored services.

- McKinsey, “The consumer demand recovery and lasting effects of COVID-19”

Online grocery market growth

The COVID pandemic was a fuel for online grocery shopping for sure. The best way to illustrate is by showing the pre-pandemic projections and comparing them with the current data.

In 2019, eMarketer forecasted the e-commerce sales to account for a 2.3% share in the total US food and beverage sales in 2020 and 3.5% in 2023. The reality turned out to be different – according to Mercatus, the online penetration reached 10.2% in the USA already in 2020.

Currently, Insider Intelligence projects that the online grocery adoption can be as high as 55% among US customers by the end of 2024. The forecast made by Mercatus and Incisiv project a 21.5% share of online grocery in 2025, which is higher than projected before the pandemic.

It proves that without COVID-19, we wouldn’t probably observe so many innovations and growth in this industry.

Why do some customers still refrain from buying groceries online?

However, there are still several customers for whom the social distancing and COVID regulations weren’t enough to decide for shopping for food online. Why is that? What are the biggest doubts related to this way of shopping?

- Customers want to see, touch and choose their food before the purchase – as Morgan Stanley’s surveys from 2016 and 2017 showed, it was the reason for 84% of customers. It was especially true for fruit and vegetables.

- Tradition – for several people, grocery shopping with their families is a routine and a tradition that they still want to cultivate.

- Price – as many as 26% of shoppers avoiding e-grocery said that “products online are more expensive than in a physical store” in 2017. We discussed the importance of price in e-commerce in our article about price checker in further detail.

- Shipping cost – prices of products are one aspect, the other one are shipping costs. If customers have a physical shop downstairs, they often decide going there to avoid the additional delivery cost.

- Time – grocery shopping isn’t always about making inventory for the next week. Sometimes it’s only about grabbing a bottle of milk or a snack. Customers don’t want to wait for it for another few hours or days, but usually need them immediately.

- Delivery – customers shopping for food expect a quick delivery – that’s why every e-grocery business should have an advanced shipping system. Another challenge is that delivery can be in some cases costly for the store (especially if it is offered for free). Products from certain categories can be large but low-margin – hence, products require a lot of space but the profit is not exceptionally high.

- Customers loyalty – As Amar Bokha (Incisiv) says: With close to 60,000 respondents across the U.S., we analyzed more than 48 million data points and found that shoppers are highly satisfied and loyal to their preferred grocery store, but this loyalty does not extend to the online channel. It means that e-grocers need to work exceptionally hard to retain customers, e.g. by developing a loyalty program. On the other hand, it is easier to win over customers that used to shop at a competitive store. One of the ways of attracting new customers is by offering exceptionally good prices. A price tracking tool can be helpful in identifying such opportunities.

- Sustainability – offering eco-friendly products and services is an aspect that more and more customers pay attention to. How can an e-grocery store improve its offer in this regard? Choosing the proper assortment is one thing; the other one is packaging. According to Amcor, over a third of respondents say packaging recyclability is very important to them when they shop for groceries online.

- Marketing mix shift – players that are used to the traditional grocery business, need to adjust their marketing efforts to the new reality. For example, customers won’t get attracted to a sweet snack while waiting in the queue. How to adjust the marketing strategy to the new market? Check in the article about marketing mix in e-commerce.

Digital grocery – what are the most popular models?

Once we know that we should be prepared for the further acceleration of e-grocery, we should ask ourselves: what are the business models that can be operated in the online grocery business? The division given by Elizabeth Bennet, VP Global eCommerce at the Kraft Heinz Company, has been often cited lately. She differentiates 3 main digital grocery models:

- Pure-play, ship-to-home – all stages of the purchase are completed digitally (discovery, transaction, in-home delivery). The best-known examples are Amazon or Walmart.

- Last mile – customers complete discovery and purchasing online, but the “last mile” – in-home delivery – is completed by businesses (e.g. Instacart).

- Click and collect / BOPIS (Buy Online Pickup In-Store) – customers buy online but pick up in-store.

Online grocery – key global players

Amazon

Amazon definitely is one of the leaders when it comes to e-grocery. According to the eMarketer study, 29% of the U.S online shoppers purchased groceries on their platform (still less than the group of 37% that chose Walmart). Amazon owns its own grocery brand as well.

How does Amazon improve its grocery shopping experience? It offers such options as:

- Fast delivery / quick pickup options – it is especially true for customers in the U.S. In 2017, Amazon acquired Whole Foods grocery chain, thanks to which it is able to assure 2-hour delivery in certain locations or a pickup within 1 hour.

- Quick access to favorite items based on past purchases

- Several product recommendations helping in making purchasing decisions

- Ability to shop by recipe

- Shop by aisle option

- One-stop shopping experience, enhanced by i.a. integration of the service into its mainline website and mobile app – it can be an important information for those who haven’t used their service recently and only know it as Pantry (discontinued) or as an option in Amazon Prime (not the case anymore, neither – the program will be retired worldwide by the end of 2021).

- In the U.S, customers will be able to add items from their Alexa shopping list to their Amazon Fresh or Whole Foods shopping cart

Apart from innovations in their ecommerce business, one interesting fact is Amazon’s brick-and-mortar grocery business. Earlier this year, the American giant opened its first Amazon Fresh store in Europe – it is located in London. We recommend reading Business Insider’s review of a visit in a cashierless supermarket: link

Instacart

Instacart is a grocery platform operating in the U.S and Canada. Their offer is wide – it includes 500 million products available both in a mobile app and via Instacart website. The size of the company can be shown by showing their growth in 2020 – from mid-March to mid-April 2020, Instacart hired an additional 300,000 workers to meet the demand caused by the pandemic.

The service allows customers to order groceries from participating retailers. One of the latest partners was 7-Eleven – ultimately, the partnership should include the same-delivery to 7,000 7-Eleven’s stores in the US.

The shopping at Instacart is done by a personal shopper. He picks, packs, and delivers the order — within one hour or up to five days in advance.

When it comes to delivery options, the fees start at $3.99 for same-day orders over $35. Fees vary for one-hour deliveries, club store deliveries, and deliveries under $35. However, Instacart tries to attract customers by offering free delivery promotions for the new users.

Walmart

Walmart, from its beginnings in the 1960s, has gone a long way toward becoming an e-grocery leader in the U.S. Its origins lie in a traditional brick and mortar business. Nowadays, it is the choice of 37% of Americans when it comes to e-grocery shopping.

Why is Walmart the first choice for so many Americans shopping for groceries online?

- Loyalty – many Americans are used to shopping in Walmar’s brick and mortar stores. Some of them might have decided for the pickup service later (which was introduced in 2015). Moving to the full e-shopping was a natural next step for them.

- One-stop shop – customers can find both e-grocery and other products in only one app.

- Fast delivery (even within 1 hour)

- Broad physical stores chain, allowing customers to pick up at a convenient location – in 2020, Walmart owned 3,200 grocery pickup sites and more than 1,600 delivery locations.

Not only giants

We have listed some biggest companies offering e-grocery. However, since online shopping for food is still evolving, there are several startups that are growing in the new environment as well.

Some of them are Buymie (Ireland), Crisp (Netherlands) or Grocemania (UK). You can check an interesting list of them here: link.