Understanding Dynamic Pricing: A Comprehensive Guide

- 08 August 2023

The need for dynamic pricing has become increasingly important as online shoppers now have access to abundant information and expect more personalized experiences. With proper implementation, dynamic pricing can be an effective way to optimize margins and increase sales, but it requires a deep understanding of market dynamics and consumer behavior. In this comprehensive guide, we’ll explore why dynamic pricing is essential for any modern ecommerce business, how it works at both industrial and retail levels, and what steps are necessary for successful implementation. So read on to learn everything you need to know about understanding dynamic pricing!

What is Dynamic Pricing and How Does it Work?

Dynamic pricing is a highly efficient tool used by retailers to maximize their profits and gain a better position in the market. By using dynamic pricing, businesses can quickly adjust prices based on certain rules and conditions set by them. This approach allows retailers to be agile and dynamic when reacting to changes in supply, demand, or competition. It also helps them build trust with customers and increase loyalty. In addition, a dynamic pricing strategy benefits from Machine Learning algorithms reinforced with data-driven insights, making dynamic pricing even more precise and effective for retailers wanting to stand out from the competition.

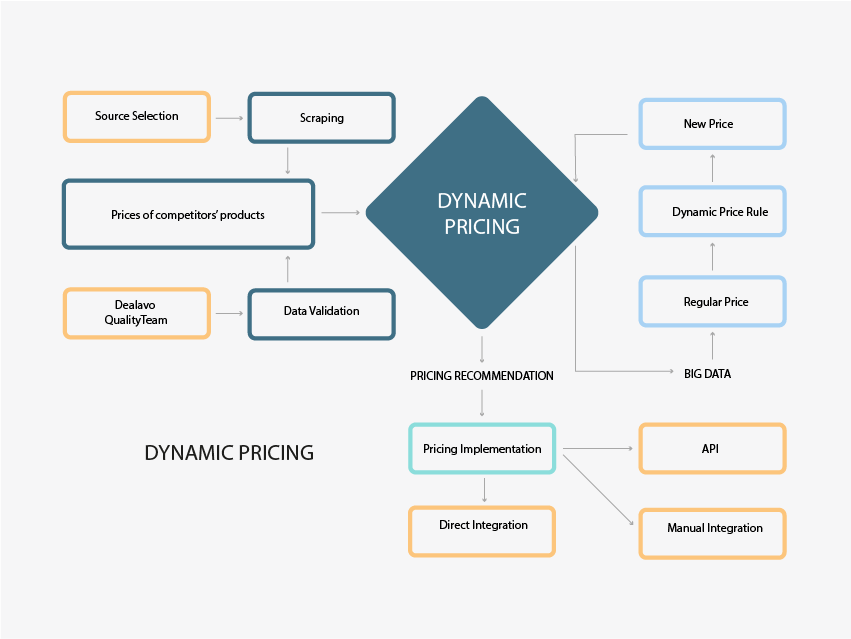

Check how the Dealavo Dynamic Pricing works:

Benefits of Implementing Dynamic Pricing in Your Business

Dynamic pricing offers a range of benefits that can greatly impact businesses and consumers alike. By leveraging the power of data and algorithms, dynamic pricing enables companies to optimize their pricing strategies, resulting in increased revenue and improved customer satisfaction.

- One of the key advantages of dynamic pricing is its ability to respond to market conditions and fluctuations in demand. By constantly monitoring factors such as supply levels, competitor prices, and customer behavior, businesses can adjust their prices accordingly. This agile approach allows them to maximize profits during peak periods while remaining competitive during slower times.

- Another benefit of dynamic pricing is its potential to enhance customer loyalty. By offering personalized pricing based on individual preferences, purchase history, or even location, businesses can create a more tailored shopping experience for their customers. This not only increases customer satisfaction but also encourages repeat purchases and fosters long-term loyalty.

- Furthermore, dynamic pricing can promote fairness by ensuring that customers pay a price that accurately reflects the value they receive. Rather than relying on static prices that may not align with market dynamics or changing costs, dynamic pricing takes into account various factors to determine the optimal price point for each transaction. This transparency helps build trust between businesses and consumers.

- Also, by utilizing pricing automation, you can gain a competitive edge. With dynamic pricing rules that adapt to market changes in real-time and personalized strategies tailored to your specific business requirements, you can optimize profits while maintaining a clear overview of performance through a user-friendly interface.

- Lastly, your revenue will skyrocket! Even a small decrease of just 1 cent can elevate products to a higher ranking on marketplaces, leading to increased sales. On the other hand, increasing prices when appropriate is also advantageous as it ensures competitive pricing for stores or makes items more exclusive.

Factors to Consider Before Implementing Dynamic Pricing

Before implementing dynamic pricing, there are several factors that businesses should carefully consider. Dynamic pricing based on various factors such as demand, competition, and customer behavior, can be a powerful tool to optimize revenue and maximize profitability. However, it is important to approach it with caution and take into account the following considerations.

Gain insight into your intended audience before establishing an appropriate pricing strategy

By gaining insight into your intended audience, you can gather valuable information about their preferences, purchasing power, and willingness to pay. This understanding enables you to tailor your pricing strategy accordingly, ensuring that it aligns with their expectations and maximizes profitability.

Dynamic pricing takes into account market fluctuations and customer dynamics. By analyzing data on customer behavior and market trends, businesses can determine the optimal price points for different segments of their audience. This approach allows for flexibility in pricing, enabling businesses to capture value during peak demand periods while remaining competitive during slower periods.

Moreover, understanding your intended audience helps you identify the value proposition that resonates most with them. By knowing what drives their purchasing decisions and what they perceive as valuable, you can position your products or services accordingly and justify the price points set.

Understand the competitive landscape

Businesses need to assess their market and industry dynamics. Understanding the competitive landscape is crucial in determining whether dynamic pricing is suitable for your business. Analyzing competitors’ pricing strategies and how they respond to market fluctuations can provide valuable insights into the potential benefits and risks of implementing dynamic pricing.

Get familiar with the technology

Another important factor to consider is the technology infrastructure required for the effective implementation of dynamic pricing. Investing in robust pricing software or working with third-party providers may be necessary to ensure accurate data collection, analysis, and real-time adjustments. It is essential to evaluate the scalability of your current systems and determine if any upgrades or integrations are needed.

Don’t overlook legal and ethical considerations

Legal and ethical considerations should not be overlooked when implementing dynamic pricing strategies. It is crucial to comply with relevant regulations regarding fair competition practices and avoid discriminatory practices that may result in negative backlash or legal consequences.

Keep an eye on your profitability

Lastly, businesses need to carefully monitor the impact of dynamic pricing on overall profitability. While the goal is typically increased revenue generation through optimized pricing strategies, it’s essential to analyze whether any potential short-term gains outweigh potential long-term negative effects such as brand reputation damage or customer churn.

Best Practices for Effective Dynamic Pricing Strategies

Dynamic pricing can seem complex, particularly at the beginning. That is why we have prepared 10 steps to help you successfully automate pricing at your store. Let’s begin!

1. Define your objectives

Think about your objectives for repricing – do you want to increase sales, achieve a better position than the competition, maximize your profits, or perhaps routinely follow the price changes of the manufacturers?

Depending on your objective, set your priorities, e.g., the minimum price below which you do not want to sell.

2. Check the competition

Analyze your competitors and their prices. Check the offers of other retailers – are they the same as yours? See how they set their prices. Analyze the historical charts to find out how the individual products were priced in the past and what circumstances could have affected this (Black Friday, seasonal sales, or interruptions in the supply chain?)

Obviously, if you have thousands of products in your offering, checking the historic charts for each of them can be time-consuming or even pointless. Select the most important products and verify their situation in the market: do they all behave the same, do they appear in the offers of similar competitors, etc. Such an analysis will make it easier for you to later select the appropriate rule, for instance, to decide if you should use a universal rule for all TOP products or perhaps diversify it for specific groups.

Checking the competition will also help you determine your position in the market. With price monitoring, you will be able to find out if your prices do not deviate from the market average too much and if they are aligned with your desired brand image (an inexpensive store for everyone or a premium brand).

3. Define your budget

Analyze your costs, such as the cost of purchase of the goods, shipping costs, fees for the e-commerce platform, and costs of returns. Make sure to also define the minimal margin you have to achieve to remain profitable.

Then, see what amount you can spend on the repricing tool.

However, remember that cheaper is not always better – if your tool uses incorrect or outdated data, even the best rules will not allow you to achieve your objective. Also, the absence of specific functions, e.g., setting the bottom price limit, may cause you to lose more than you save.

4. Select the right repricing tool

Find a repricing tool that meets your needs. Analyze the options, taking into account their functions, the availability of integration with your e-commerce platform, and costs. Try out a demo version, examine the interface, and check the quality of customer service.

For starters, you can try out the 7-day demo of the Dealavo tool.

5. Configure the repricing tool

After selecting the right tool, configure it according to your needs. Connect your account to the online store and adjust the repricing strategy settings.

This is the most important moment – after all, an incorrect configuration can cause even the best strategies to fail. However, if everything is implemented correctly, a large portion of your everyday duties will be automated, giving you more time to focus on other activities and significantly improving the functioning of your store.

6. Define your KVI and set the repricing rule

Before you proceed to define specific repricing rules, you should know what products you want your rules to apply to – in other words, you should find your KVI (Key Value Items), i.e., the items that generate traffic in your store.

Why is this important?

KVI is the part of your offering that is the easiest to compare, which means that it is the most sensitive to competition. The products classified as KVI should thus be priced best to attract the maximum possible traffic to your store.

The situation is slightly different with products from the “long tail”, i.e., the part of the offering purchased as an accessory to the main purchase. These may, for instance, include a phone charger, a laptop bag, or a TV cable. The vast majority of consumers do not compare these products because they are, in a way, “less important”. That is why it is easier to sell them with a higher margin (at a price similar to the market average) than the KVI.

How to apply this knowledge in practice? Let’s look at the following example:

Assume you are an electronic retailer offering smartphones and GSM accessories. Your KVI are iPhones, particularly iPhone 13, and that is why you want to offer the lowest price for this part of your offering.

What should you do?

Firstly, define a specific objective, e.g., “I want my average position in the Ceneo ranking to be 1.5 within the next month”.

Then, check your position in the price monitoring tool, verifying your starting position and the average position after one month.

Does this position increase traffic on your website? If not, try out another pricing strategy – perhaps an average position in the market will increase your profits while only slightly reducing traffic?

7. Remember about price limits

In repricing tools, it is important to introduce margin limits and minimum price, which set the bottom price limit below which you do not want to sell your products.

Margin limits are important because they enable you to control the degree of price increase or decrease depending on the competition. For instance, you can set the margin limit to 10%, which means that your margin should not be lower than 10% relative to the prices of the competition.

Think about how to react if the prices of your competitors drop below your limits. Would you like to remove the product from the promoted offering or perhaps set the minimum price automatically?

On the other hand, you should also prepare for the situation where your competition is having stock-outs of a competitive product. You should decide what to do with your prices in such a situation. It may also be helpful to define the maximum price, i.e., the upper price limit defining the highest acceptable price for which you are willing to sell your products according to the image of your brand and the buying power of your target group.

8. Don’t forget about price endings

Price endings, such as 99, 95, 90, etc., have a psychological effect on how your prices are perceived by your customers. Endings such as “99” are often preferred by consumers because they make the price of the product seem smaller than the actual value.

9. Set e-mail alerts

E-mail alerts in the repricing tool are an important part of price automation and competition monitoring in e-commerce. They allow you to receive important notifications to the e-mail box or in the application in case of significant changes, such as price changes at the competition or reaching specific price thresholds.

For instance, at Dealavo, you define custom names for e-mail alerts and then pick the category for the alert. In our application, you can select one of the following groups:

– positive trend,

– negative trend,

– easy profit,

– clever move,

– price increase,

– price reduction.

For more information about using our alerts, read the detailed instructions we have prepared for you.

10. Monitor your results and update your strategy

Regularly monitor repricing results. Since there is no universal strategy/rule, do not be afraid of experimenting and implementing new solutions.

Case Studies: Successful Examples of Dynamic Pricing

Among the successful examples of dynamic pricing, Adrenaline.pl stands out as a prime illustration of how this strategy can lead to remarkable results.

In a market filled with fierce competition and a constant race to attract new customers with low prices, finding the right balance between profit margins and sales volume is crucial for success. Adrenaline.pl faced this challenge head-on and turned to Dealavo for a solution.

By using Dealavo’s innovative pricing tool, Adrenaline.pl was able to adjust their prices on Google Shopping to match their competitors, ultimately increasing their return on ad spend (ROAS) by an impressive 29% in just one month!

Discover how Dealavo helped Adrenaline.pl achieve this remarkable feat and revolutionize its profitability in the industry.

See the case of Adrenaline.pl

Common Mistakes to Avoid in Dynamic Pricing

As appealing as dynamic pricing may be, its successful implementation requires careful consideration and vigilance to avoid potential pitfalls and mistakes. In this subsection, we will explore some of the most common challenges faced by businesses when implementing dynamic pricing strategies.

Lack of accurate or reliable data

Dynamic pricing relies on real-time data to make pricing decisions. Without accurate and up-to-date data, your pricing strategy may be flawed and lead to ineffective results. Make sure you have a reliable system in place to collect and analyze data.

Overcomplicating pricing algorithms

It’s easy to get carried away with complex pricing algorithms, thinking it will optimize your profit. However, overly complicated algorithms can make it difficult to understand how prices are determined, leading to confusion for both customers and your team. Keep your pricing algorithms simple and transparent.

Ignoring customer perception

While dynamic pricing can be beneficial for your bottom line, it’s important to consider how your customers perceive it. If customers feel like they are being taken advantage of or if the pricing changes too frequently, it can erode trust and loyalty. So, always be mindful of customer perceptions.

Lack of testing and monitoring

Dynamic pricing is not a set-it-and-forget-it strategy. It requires regular testing and monitoring to ensure that it’s working effectively and generating the desired results. Set up systems to track your pricing decisions and make adjustments as needed.

Margin omission

Dynamic pricing strategies offer a promising avenue for maximizing profits; however, it is crucial not to overlook profit margins during their implementation. Ensuring that the set prices remain profitable is essential, preventing the inadvertent sale of products or services at a loss.

Dynamic Pricing vs. Static Pricing: Which is Right for Your Business?

When it comes to pricing strategies, businesses often find themselves at a crossroads between dynamic pricing and static pricing. Both approaches have their merits, but determining which one is right for your business requires careful consideration.

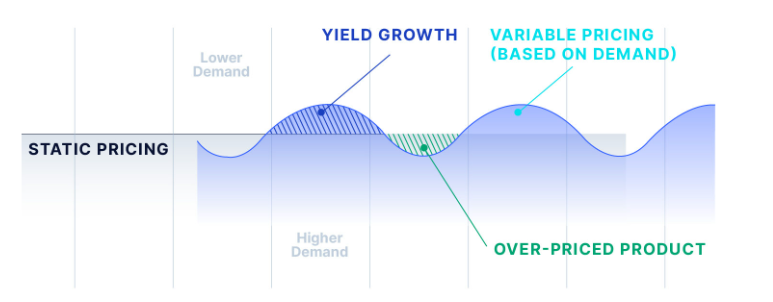

Static pricing represents the conventional approach where operators offer tickets at a fixed price, irrespective of the purchase or usage time. These pricing decisions typically rely on historical data or intuition, resulting in missed revenue opportunities. Under static pricing, operators often charge lower prices on their peak days and higher prices on slower days, leading to potential underpricing and overpricing issues.

Source: https://www.catalate.com/

Dynamic pricing, as the name suggests, involves adjusting prices in real-time based on various factors such as demand, competition, and market conditions. This strategy allows businesses to maximize revenue by charging higher prices during peak periods or when demand is high and offering discounts during slower periods to attract customers.

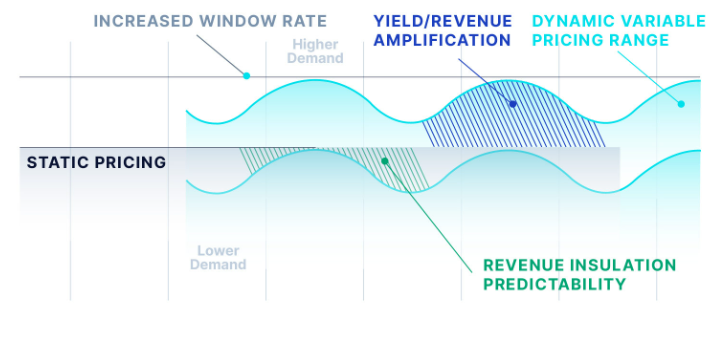

On the other hand, dynamic pricing entails tailoring daily prices based on demand, where costs escalate as customers approach the scheduled trip date. The availability of limited inventory at each price level enables automatic adjustments, reacting to customer demand fluctuations. As a result, operators benefit from heightened operational and financial predictability compared to conventional variable pricing strategies.

Source:https://www.catalate.com/

The decision between dynamic pricing and static pricing depends on several factors such as industry dynamics, target market, product/service characteristics, and business goals. For example, if your business operates in a highly competitive market with fluctuating demand patterns, dynamic pricing may be more suitable as it allows you to stay agile and respond quickly to changing market conditions.

However, if your business offers niche products/services with stable demand or if you prioritize customer loyalty over short-term revenue optimization, static pricing might be a better fit. It provides transparency and predictability for customers while simplifying internal operations.

Ultimately, there is no one-size-fits-all answer when it comes to choosing between dynamic pricing and static pricing. It’s essential to carefully evaluate your unique business circumstances and consider the potential benefits and drawbacks of each approach before making an informed decision that aligns with your overall strategy.

How to Get Started with Dynamic Pricing

Utilizing dynamic pricing can help grow profits, but it’s important to set up a system that works for you. For instance, at Dealavo you can do so in four easy steps:

- First, determine the products or categories on which you want to implement varying prices.

- Specify your rules according to each product’s needs – such as sales channels, locations, etc.

- Let the system propose price changes for maximum efficiency- choose whether those offers will be applied automatically or require approval before being put into effect.

- To ensure continual success in using this strategy and make sure all of your efforts are paying off – monitor outcomes closely; tweaking variables when necessary by testing different repricing strategies!

How to get started with Dynamic Pricing?

Tools and Software for Dynamic Pricing Management

Dealavo

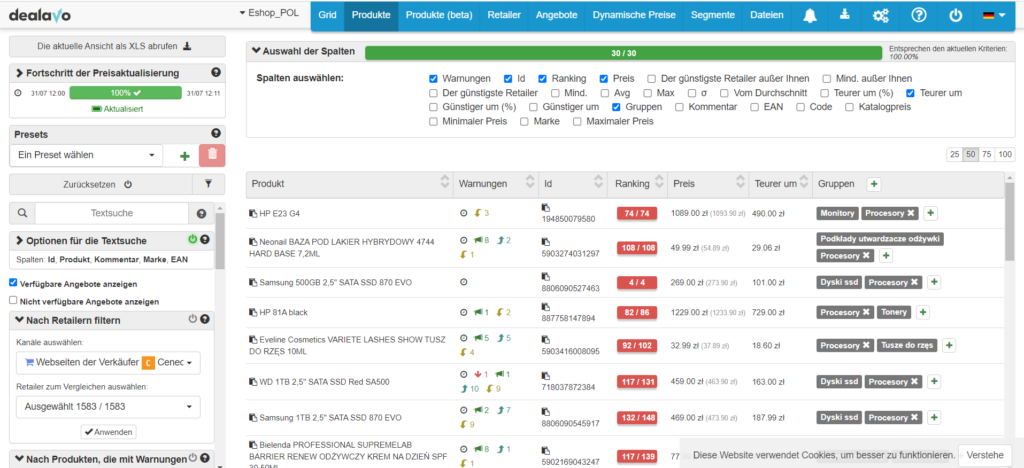

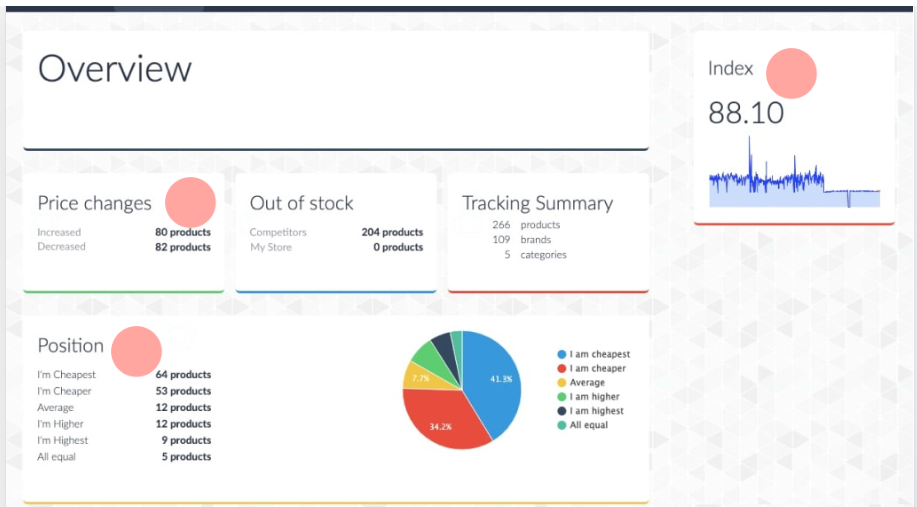

Dealavo stands out as exceptional software, catering effectively to both brands and e-shops. With its versatile structure, it boasts an extensive array of features, including price promotion tracking, numerous integrations, banner monitoring, and advanced machine learning algorithms.

When it comes to dynamic pricing efficiency and accuracy, Dealavo indisputably ranks among the top tools available. With a remarkable capability to handle nearly 700k product offers, it extends its services worldwide, demonstrating its extensive experience and expertise. Customer satisfaction levels are notably high, a testament to Dealavo’s superior performance in price tracking software, offering an impressive range of features, user accessibility, and intuitive ease of use.

Prisync

Prisync serves as a valuable tool tailored primarily for online shops, empowering them to monitor competitors and establish effective pricing strategies. It has garnered a reputation for its seamless data import and export procedures, as well as its precise price and stock availability tracking capabilities.

For businesses in search of a dependable dynamic pricing solution, Prisync stands out with its user-friendly and intuitive UI. Notably, it excels in customer service, setting itself apart from other similar tools in the market.

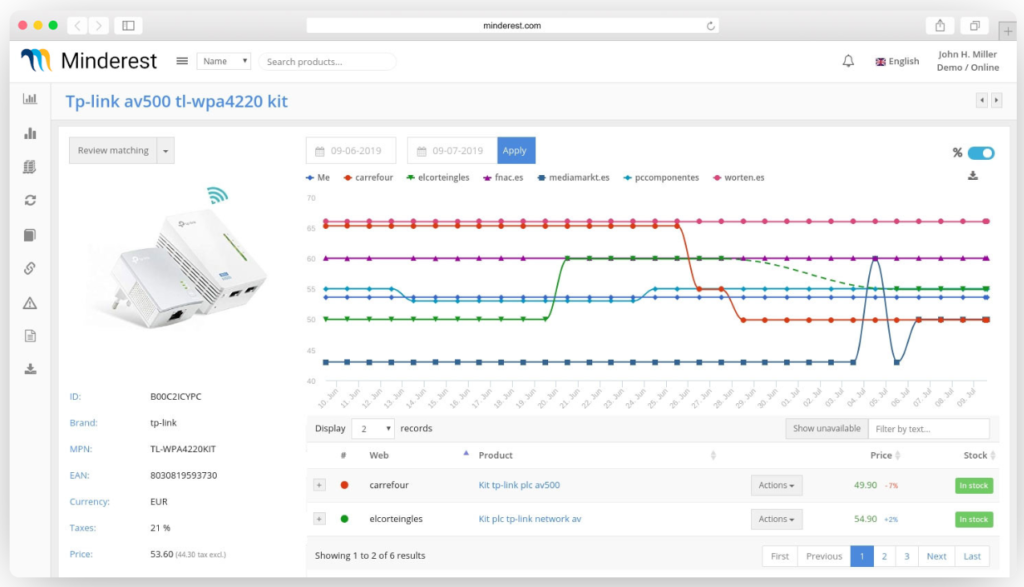

Minderest

Minderest offers comprehensive competitor price analysis software equipped with dashboards, historical data, and market trend insights. By furnishing users with essential information, it becomes a crucial tool for precise planning, establishing, and refining an effective dynamic pricing strategy.

The software caters to brands and e-shops by providing MAP & MSRP monitoring and ensures content compliance. Additionally, it offers raw, accurate data accessible through web API, making it suitable for all types of companies seeking robust pricing solutions.

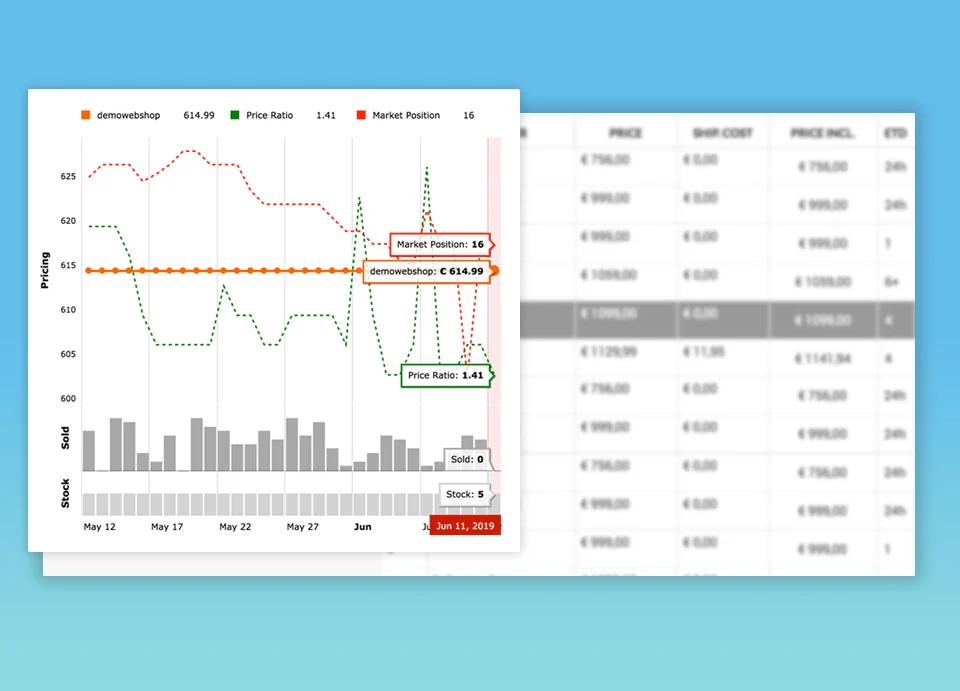

Omniaretail

Omniaretail proves to be an invaluable tool designed primarily for retailers. It emerges as an excellent dynamic pricing solution due to its diverse array of features, enabling precise alignment of strategies with the business’s core objectives.

While initially, some users might find Omni’s formulas a bit daunting, with continued use, the platform becomes more straightforward and user-friendly. It excels in providing high-quality data, sourced from multiple channels, including comparison shopping engines and competitors’ websites.

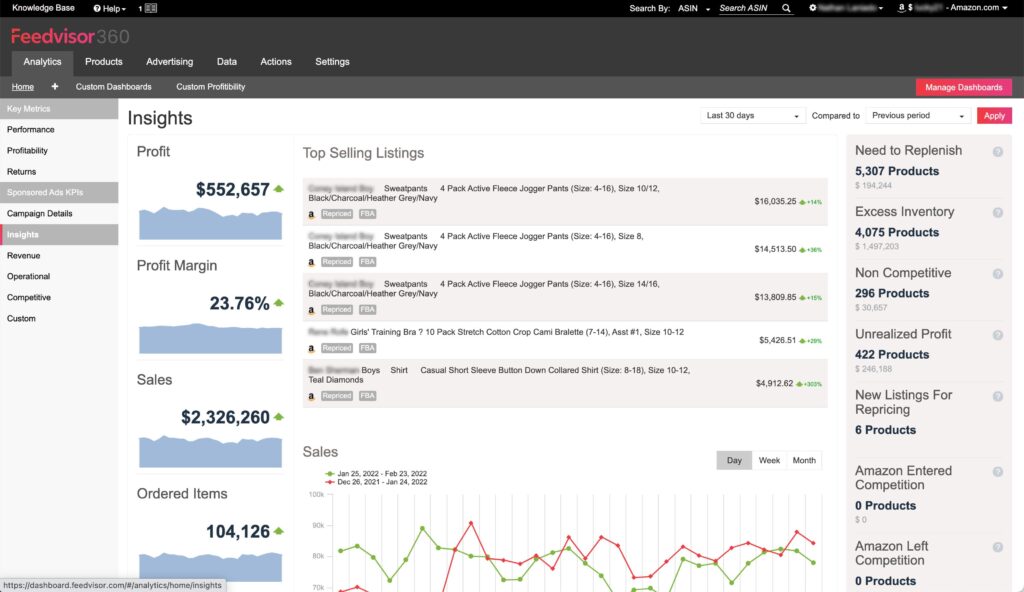

Feedvisor

Last but not least, there is Feedvisor, a powerful tool catering to diverse companies, enabling accurate competitor price tracking through AI algorithms. It extends its services to popular platforms like Amazon and Walmart.

Feedvisor’s standout features include 3P Storefront Launch and Management, Content Listing Optimization, and Marketplace Cleaning. The integration of professional expertise with effective AI algorithms makes Feedvisor a robust and compelling software worth exploring.

Understanding Price Elasticity and its Role in Dynamic Pricing

Have you ever wondered how businesses determine the prices of their products or services? Well, that’s where the concept of price elasticity comes into play. Price elasticity refers to how responsive consumers are to changes in price. If a product has high price elasticity, it means that even a small price change can result in a significant change in demand. On the other hand, if a product has low price elasticity, it means that price changes have a much smaller effect on demand.

Price Elasticity of Demand (POD) is a microeconomic concept that measures how changes in the price of a product affect the demand for that product. The formula is simple:

POD = (% change in quantity of the demanded good) / (% change in price of the demanded good)

When the value of POD is greater than 1, we consider the demand to be elastic. On the other hand, when it’s lower than 1, the demand is inelastic. In simpler terms, if even a small fluctuation in price significantly affects the demand for a product, it is elastic. Conversely, if the quantity demanded remains relatively stable despite changes in price, the product is considered inelastic.

Several factors influence the price elasticity of demand, including the type of product, consumer urgency to purchase, brand loyalty, and the availability of substitutes. Let’s explore some examples to see how this concept plays out in the real world.

Elastic Demand

Elastic demand refers to situations where even slight changes in price have a substantial impact on the quantity demanded. Examples of elastic goods include soft drinks, clothes, electronics, and sweets. These products are considered non-essential, and consumers are more likely to purchase them when the price is attractive. If the price becomes unappealing, they might choose to postpone their purchase or opt for substitutes.

For instance, if a clothing brand increases its prices significantly, consumers may decide to look for alternatives or wait for discounts before making a purchase. The electronics market is highly competitive, and consumers often seek out cheaper options or promotions from different manufacturers. This correlation means that reducing the price of elastic goods can lead to a surge in sales, but raising the price can result in a substantial loss.

Inelastic Demand

Conversely, perfectly inelastic demand is a theoretical concept that rarely exists in reality. Nevertheless, there are numerous examples of inelastic goods, including life-saving medicines, gasoline, electricity, cigarettes, and premium brand products. These items fulfill essential needs, and consumers tend to continue buying them regardless of price fluctuations.

For instance, drivers will maintain a relatively stable level of gasoline consumption, regardless of small price changes. Similarly, smokers are unlikely to give up their habit due to increased cigarette prices. While producers or retailers of inelastic goods can afford higher pricing strategies, excessively raising prices might still result in decreased demand.

Leveraging Price Elasticity of Demand in Pricing Strategy

Understanding and accurately calculating price elasticity allows retailers to maximize their revenue. For inelastic products, steep discounts may not be wise, but for elastic goods, promotions can quickly stimulate demand and boost sales.

To develop an effective pricing strategy, retailers must carefully monitor consumer behavior and reactions to price changes. Market monitoring tools can provide valuable insights by tracking the relationship between product quantities and prices, enabling retailers to make data-driven decisions about their supply and offerings.

Moreover, keeping an eye on competitors is essential. Knowing their prices, promotions, and product offerings can help retailers stay competitive and adjust their strategies accordingly. Manual monitoring can be time-consuming and prone to errors, but modern price monitoring tools offer automated solutions, providing up-to-date and relevant data with minimal effort.

Dynamic Pricing in the Retail Sector

Dynamic pricing has emerged as a game-changer in the retail sector, allowing businesses to tailor their prices based on various factors, such as demand, competition, and customer behavior. Retailers that have successfully implemented dynamic pricing strategies have followed some key principles while avoiding common pitfalls. Let’s explore the dos and don’ts that can help retailers excel in this dynamic pricing landscape.

Dynamic Pricing in the Retail Sector – Dos

1. Focus on the Final Price

Customers don’t just consider the listed item price; they evaluate the total cost, including taxes, shipping fees, and additional charges. Retailers must align their dynamic pricing strategy with the chosen value proposition, making thoughtful decisions about promotions, personalized offers, and shipping options. Testing options like longer delivery times at lower fees can provide flexibility while driving conversions.

2. Value Consumer Expectations

Not all products are suitable for frequent price changes. Retailers must assess the purchase cycle and customer expectations for each product category. Big-ticket items that require extensive research, like TVs or sofas, should have relatively stable prices to avoid customer frustration. Transparency and approval of price changes can prevent consumer backlash and maintain trust.

3. Monitor and Improve

Dynamic pricing is a mix of art and science, requiring a test-and-learn approach. Starting with pilots in specific product categories or regions can help manage risk. Analyzing the impact of price changes and making quick adjustments based on real-time data is vital. Collaboration between pricing analysts and merchants can lead to valuable insights and automated price-setting systems.

4. Prepare Your Strategy Carefully

Understand your current competitive position and consumer perceptions of your brand. Develop a phased approach to build data, infrastructure, tools, and talent. Quick wins can demonstrate the effectiveness of the dynamic-pricing strategy and gain support across the organization.

Dynamic Pricing in the Retail Sector – Don’ts

1. Don’t Alienate Customers

Dynamic pricing should align with the brand and deliver the desired customer experience. Dramatic fluctuations in prices can confuse and alienate customers, leading them to seek alternatives. Pricing should remain consistent across devices and channels to avoid confusion and attrition among customers.

2. Don’t Change Prices Unnecessarily

Price adjustments should have valid triggers, such as seasonal changes or upcoming product launches. Avoid changing prices if underlying factors like costs or competitors’ prices remain unchanged. Communicate price reductions to customers to maximize their impact.

3. Don’t Rely on Bad Data

Accurate data is the backbone of successful dynamic pricing. Inaccurate or generalized inputs can lead to misleading price recommendations and result in margin losses. Prioritize cleaning up pricing inputs and improve accuracy in cost attribution for better price recommendations.

Retailers that embrace dynamic pricing can gain a competitive edge in today’s rapidly evolving market. By adhering to the winning elements and avoiding common pitfalls, retailers can develop effective dynamic pricing strategies that resonate with customers and drive sustainable growth. As the retail landscape continues to evolve, mastering dynamic pricing will become an increasingly vital skill for retailers to thrive in the future.

Legal and Ethical Considerations in Dynamic Pricing

While dynamic pricing offers benefits like increased revenue and improved customer satisfaction, it also raises important legal and ethical considerations that must be carefully addressed.

One key legal consideration in dynamic pricing is ensuring compliance with antitrust laws. Businesses must avoid engaging in anti-competitive behavior such as price fixing or collusion with competitors. By using dynamic pricing algorithms responsibly, companies can ensure fair competition and avoid legal repercussions.

Ethical considerations also come into play when implementing dynamic pricing strategies. Transparency is crucial to maintaining trust with customers. Businesses should clearly communicate the factors that influence price fluctuations and provide customers with accessible information about how prices are determined. This transparency helps prevent feelings of unfairness or discrimination among consumers.

Another ethical consideration is avoiding price discrimination based on personal characteristics such as race, gender, or socioeconomic status. Dynamic pricing algorithms should be designed to treat all customers fairly and not exploit vulnerable individuals who may have limited purchasing power.

Price discrimination can have at least three different forms, which are called degrees of price discrimination.

First-degree price discrimination

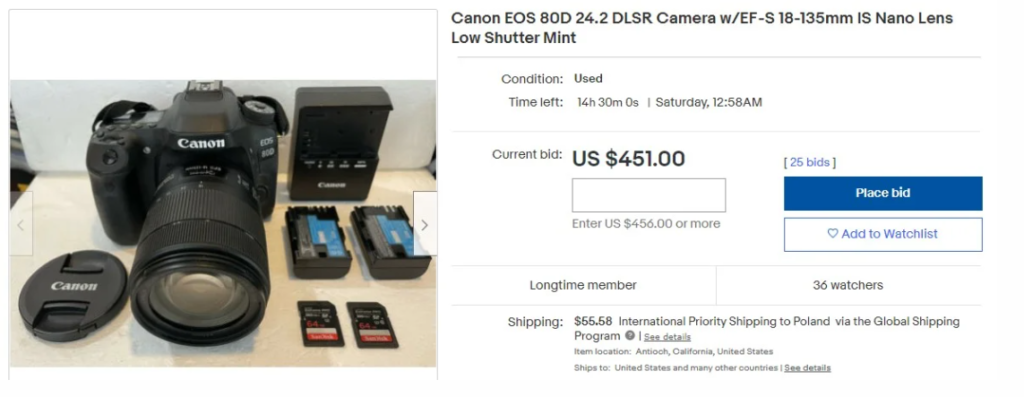

In the first degree, you allow customers to pay for the product as much as they want. A textbook example of first-degree price discrimination is eBay. Customers are bidding on product prices, and the more they are willing to pay, the higher the final cost of the product is.

The more users are willing to pay, the more expensive this camera is.

Second-degree price discrimination

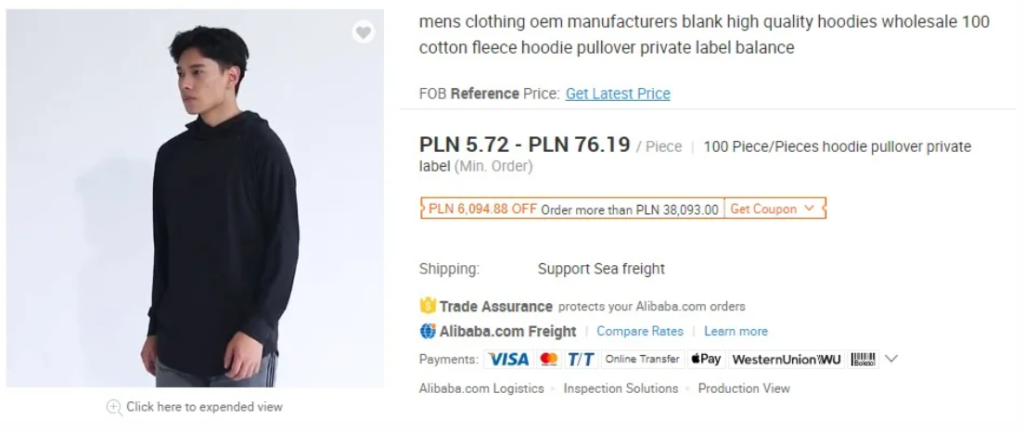

Here, prices are based on the quantity of purchased products. In short, the more products you buy, the per-unit cost is lower. This is how wholesaling and bulk discounts work. In other words, the same pair of socks can cost you 5 USD (when you purchase just 1 pair) or 2 USD (if you buy 5 pairs).

The more products you buy, the cheaper the hoodie is. The per-unit price difference in our example is a whopping 1230%!

Third-degree price discrimination

When it comes to third-degree price discrimination, sellers segment their customers based on specific attributes and behaviors. A typical example is an airline website that can show you utterly different prices of the same flight based on your previous searches and availability of seats. Another common example of third-degree price discrimination is a student discount.

ISIC.org offers discounted prices for various products and services for their card users.

Furthermore, data privacy is a significant concern when it comes to implementing dynamic pricing strategies. Companies must handle customer data responsibly and ensure compliance with relevant data protection laws to protect consumer privacy rights.

Data Analysis and Forecasting in Dynamic Pricing

Data analysis plays a crucial role in dynamic pricing by extracting valuable insights from large volumes of data.

By analyzing historical sales data, customer preferences, and market trends, businesses can identify patterns and correlations that help them determine the optimal price points for their products or services.

Forecasting is another key component of dynamic pricing. By using advanced statistical models and algorithms, businesses can predict future demand patterns and adjust prices accordingly. This enables them to capture maximum value from each transaction while ensuring customer satisfaction.

The benefits of implementing dynamic pricing with data analysis and forecasting are numerous. It allows businesses to increase revenue by charging higher prices during peak-demand periods or offering discounts during low-demand periods. It also helps them stay competitive by responding quickly to changes in market dynamics.

Challenges and Limitations of Dynamic Pricing

Along with its numerous benefits, dynamic pricing also presents some significant challenges that retailers must navigate. Let’s explore the key challenges of dynamic pricing and their potential implications for businesses.

1. Angry Customers

One of the potential drawbacks of dynamic pricing is the risk of irritating or even angering customers, especially if they perceive price discrimination. For instance, if travelers compare ticket prices on a flight and discover that they paid significantly more than other passengers for the same seat, it can lead to feelings of being duped or cheated. Such customer dissatisfaction can harm the company’s reputation and erode trust in the brand.

2. Customer Loyalty Decrease

Customer loyalty is a valuable asset for any business, as loyal customers tend to make repeat purchases and stick with a company’s products or services. However, dynamic pricing practices that lead to customer irritation or perceived unfairness can undermine brand loyalty. When customers feel that a company is using dynamic pricing to their disadvantage, they may seek out alternative options and explore competitor offerings to ensure they get the best value for their money.

3. Expanding Competition

Dynamic pricing can intensify competition in the market. Customers who are aware of dynamic pricing tactics may become less loyal to a particular brand and be more inclined to shop around for the best deals. With online shopping making it effortless to compare prices across multiple retailers, businesses find themselves in a fierce battle to offer the most attractive prices. This heightened competition may lead to a downward spiral in product prices, reducing profit margins for retailers but benefiting price-sensitive consumers.

4. Complexity and Transparency

Implementing dynamic pricing systems can be complex and requires sophisticated algorithms and data analysis. Maintaining transparency in pricing strategies becomes crucial, as customers may become skeptical if they sense a lack of clarity or hidden motives behind price fluctuations. Retailers must communicate their dynamic pricing strategies clearly to build trust with their customers.

5. Consumer Privacy Concerns

Dynamic pricing relies heavily on data collection and analysis to understand consumer behavior and set prices accordingly. However, this also raises privacy concerns, as customers may feel uncomfortable knowing that their personal information is being used to determine prices. Retailers must ensure strict data protection measures and be transparent about their data usage to address these concerns.

6. Timing and Implementation

Determining the right time to adjust prices dynamically can be challenging. Price changes at the wrong moment can lead to unintended consequences, such as customer backlash or excess inventory. Retailers must carefully analyze market trends and customer behavior to time their price adjustments effectively.

7. Regulatory and Legal Considerations

Dynamic pricing may encounter legal challenges in some jurisdictions, especially if it borders on unfair or deceptive trade practices. Retailers must ensure compliance with pricing regulations to avoid potential legal issues and reputational damage.

Integrating Dynamic Pricing with Other Platforms

Dealavo offers seamless integration of price data with the leading e-commerce platforms and ERP systems, providing users with effortless access to valuable information.

Two primary integration methods are available:

- Utilizing our API;

- Directly integrating the data into the ERP system or store platform.

When talking about direct integrations, you can integrate your Dealavo account with the most popular and important platforms such as Shopware and WooCommerce.

Dynamic Pricing on Amazon

We’ve made sure to fully integrate Dealavo with Amazon. What’s more, our advanced machine learning algorithms conduct a double data verification, which means you have access only to high-quality, verified data.

With our platform, you can monitor all the relevant elements of this marketplace, including your competitors’ prices, even outside the buy box. What’s more, you can track Amazon prices whether you are a seller or a manufacturer and want to determine deviations from MSRP prices (suggested prices). If you operate in the USA, you can track MAP prices (minimal prices) as well. In the same way, you can use our platform to monitor price violations.

Additionally, Dealavo provides you with the opportunity to track product price history so that you know when the price reaches the highest level or whether a specific product is really getting cheaper during sales peaks such as Black Friday or Christmas.

Dynamic Pricing on E-bay

On eBay, where thousands of sellers are vying for the attention of millions of buyers, dynamic pricing can give you a significant edge. It allows you to stay ahead of the competition, adapt to market changes swiftly, and create a personalized shopping experience for your customers.

With Dealavo’s dynamic pricing feature, you can create customized pricing strategies tailored to your business goals. You can set up rules to automatically adjust prices based on parameters such as stock levels, competitors’ prices, or demand fluctuations. This ensures that your prices are always competitive and attractive to potential buyers.

Dynamic Pricing on Magento (SOTE)

Magento (SOTE) is a popular open-source e-commerce platform that allows businesses to create and manage online stores. It provides a flexible and customizable solution for building robust e-commerce websites with a wide range of features and functionalities. Magento offers various editions, including Magento Open Source (formerly Magento Community Edition) and Magento Commerce (formerly Magento Enterprise Edition), each catering to different business needs.

By integrating SOTE and Dealavo platforms, you will gain insight into your competitors’ pricing tactics and develop a winning pricing strategy. You can be sure that your store will remain competitive and will keep drawing new customers with attractive offers.

Dynamic Pricing on Shoper

Shoper is a popular e-commerce platform based in Poland, providing solutions for creating online stores.

If you are using the Shoper platform, you will certainly be interested in the integration with Dealavo – it will give you full insight into the pricing actions of your competitors and let you develop an effective pricing strategy.

Dynamic Pricing on Zalando

Zalando is a leading e-commerce platform that offers an extensive selection of fashion, footwear, and lifestyle products. With its growing customer base and advanced technology solutions, Zalando is quickly becoming one of the most popular e-commerce stores in Europe. Therefore Zalando marketplace is becoming a highly competitive space where businesses are constantly looking for ways to increase their sales.

By regularly monitoring, you can gain insights into your competitors’ pricing strategies and tactics, allowing you to adjust your own pricing strategy accordingly to stay competitive. For example, by optimizing your pricing strategy, you can lower your prices to be more competitive or increase your prices to make more profit.

Now, you can be always up-to-date thanks to the Dealavo & Zalando integration.

Dynamic Pricing on Idealo

Idealo is a price comparison website as well as an e-commerce engine established in Germany in 2000, available for retailers from many European countries, including the UK, Italy, France, and Spain.

On Idealo vendors have a few possibilities to follow the price changes. One of them is a tracking performance pixel. Additionally, these pixels also give the vendor a full customer history of activity which may be helpful e.g. to improve pricing strategy in the future.

You can also improve your sales volume as well as keep an eye on competitors, thanks to its integration with Dealavo.

Dynamic Pricing on Comarch Optima

Comarch Optima is an enterprise resource planning (ERP) software solution developed by Comarch, a global provider of IT solutions and services. Comarch Optima is designed to help businesses streamline their operations, manage resources, and improve overall efficiency across various departments.

If you use the Comarch Optima platform in your online store, with Dealavo integration you will be able to:

- update the prices of your products according to the current market situation to stay competitive and maintain the right margin,

- adjust your product base thanks to multiple reports available.

Future Trends in Dynamic Pricing: What to Expect

The future of dynamic pricing appears promising. In an era where technology is advancing at an unprecedented pace, dynamic pricing holds immense potential for shaping the future of pricing strategies.

Gone are the days of static price tags that remain unchanged for extended periods.

This pricing approach has found success in various industries, including sports, where teams have used dynamic pricing for ticket sales to boost revenue. Retail giants like Amazon and Walmart are strong advocates of dynamic pricing, constantly adjusting their product prices to stay competitive and stay ahead of the competition.

Retailers are increasingly turning to technology to automate dynamic pricing, leveraging price optimization software to improve gross margins and make a significant impact on sales and profit. Automation helps ensure that pricing aligns with the retailer’s brand identity and avoids engaging in margin-depleting price wars.

Looking ahead, dynamic pricing is expected to become more customer-centric with personalized pricing based on customer data and preferences. As technology continues to advance, retailers will benefit from real-time data analytics and AI algorithms, enabling more agile and data-driven pricing decisions.

Overall, dynamic pricing is becoming a standard pricing strategy in the retail industry, offering a powerful tool for retailers to optimize sales and profitability while staying competitive in a dynamic marketplace.