Target return & target pricing – what is rate of return with examples

- 14 July 2021

Today, we want to show you two approaches to setting the perfect product price that work opposite to value-based pricing or cost-plus pricing. In target return and target pricing alike, you start with the desired price and then adjust all the other elements to it. Does it sound unreasonable to you? Let’s check that by examining both these pricing strategies.

Although target return and target pricing have a lot in common, these strategies are, in fact, different, and they are used in different business setups. Let’s examine the target return first.

Target return

The target return is a pricing method that’s closely associated with an investment related to a specific product/endeavor. The target return is calculated based on the amount of money invested in a particular venture, including the profit that the investor wants to see in return, adjusted for the time value of money.

Of course, this means that the target return must be adjusted both to the investor’s expectations and the time in which this return can be reached. For example, if our hypothetical investor wanted to get a high return over a short period, the project would have to be very profitable in the short run. Under such circumstances, the company would have to set the product’s final price at a high level and count on the high volume of sales because otherwise, the target return wouldn’t be attainable.

Now, how does this model differ from cost-plus pricing? In the cost-plus pricing model, you always start with the cost of the product. Then, you add your margin, and, this way, you end up with a final price. In the cost-plus pricing strategy, elements like time or volume of sales don’t play any significant role. Here, they do.

To make this question more straightforward, we should explain what a rate of return (RoR) actually is:

WHAT IS THE RATE OF RETURN?

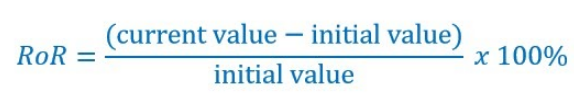

Shortly put, the rate of return (RoR) is the net profit from an investment over a specified time. The RoR value is expressed as a percentage of the investment’s initial cost and can be calculated using this simple formula:

Additionally, remember that inflation is not taken into account when calculating RoR in its simplest form. If you want to include this variable in your calculations, you have to use the so-called real rate of return (also known as the inflation-adjusted rate of return).

RATE OF RETURN EXAMPLE

Suppose we have a venture that initially required 5,000 USD. That’s our initial value. Today, one year later, the current value is 12,000 USD. This means that the RoR is 140%.

In its simplest form presented above, the rate of return is frequently called the basic growth rate or return on investment (ROI). It is used to see how much money an investor has made (or lost, for that matter) on a specific project/venture. And that’s what we focus on in target return – how much our investor will make over a particular time. That’s a base for the future product price.

Now, let’s talk about target pricing.

Target pricing

This pricing strategy is in many ways similar to target return. Here, we also start with the desired price of the final product. Companies using this strategy, typically base on the insights coming from diverse forms of research, look for the most profitable price that customers should be willing to pay. This price is then fixed as a final selling price.

Again, let’s use a straightforward example. Suppose we have a company that produces and sells premium phone cases. Similar cases are sold at 15-20 USD. Our company wants to attract premium customers, so they set the price at 25 USD per unit. Now, it’s time for the margin. They want to make 30% on every phone case sold, so their margin is at 7.5 USD per case. This means that they have to produce these phone cases for under 17.5 USD a pop.

PROS AND CONS OF TARGET PRICING

Let’s talk about the pros first. This strategy is used to assess how low the production cost can be without changing the final price of the product. Such an approach can improve company’s efficiency and bring higher profits. Secondly, starting with the price allows you to base it on customer expectations and needs, not production cost. In effect, frequently, the final price accurately reflects the amount of money customers are willing to pay for the product. And thirdly, this strategy allows companies to use it to improve their operations over time, as it’s all about cost efficiency and cost management.

And what about the cons? First off, if the final price isn’t calculated accurately, it will result in poor sales results. Therefore, you need thorough market research before you put your product on sale. Additionally, this pricing strategy can put a lot of pressure on different departments within the company to lower expenses. Eventually, this could result in the reduced quality of the final product.

To sum up, target pricing can be effective, but it has to be preceded by full market research. And remember, don’t fall into the trap of lowering the product’s quality. It’s a recipe for disaster.

MAP/MSRP tracking for brands

If you run a company that sells products using the target pricing strategy and you want to make sure your distributors and partners offer your products at agreed prices, go for our price and promotion tracking tool.

Thanks to Dealavo’s tools, you will be able to track the implementation of your target pricing strategy by key partners and distributors. This way, you can quickly spot MAP/MSRP violations in online stores, marketplaces, and price comparison websites worldwide.