Psychological pricing – how does it work?

- 30 March 2021

We entitled this blog post “Psychological pricing – HOW does it work?” for a reason. Today, no one doubts that diverse psychological pricing strategies do work and help you attract more customers. In fact, thousands of online stores worldwide use them extensively to sell as many products as possible at the prices bringing the highest profits. In this article, we are going to take a closer look at psychological pricing strategies. You will find out which ones are the most effective and discover how you can apply them in your store. Let’s get down to business!

Even though price comparison websites and engines are designed to find the best deals, psychological pricing strategy still plays a vital role in e-commerce and retail. Simply because it works, and customers don’t always make well-informed, rational decisions. For you, as an online store owner, this means that a well-thought-out psychological pricing strategy can get you more customers and more sales with little effort.

In this article, we want to show you seven of the most efficient psychological pricing strategies. Obviously, you don’t have to utilize all of them simultaneously. It’s usually best to try each one of them and keep these that turn out to be effective in your particular situation.

The most powerful psychological pricing strategies

We have to be honest here; the vast majority of these strategies are based on a simple fact: People are impetuous and frequently make unreasonable choices. In 2015, a consulting company McKinsey released an “Irrational consumption: How consumers really make decisions” study that stated:

“A shopper’s mind is not a clean slate. Information and experience are refracted through the lens of belief. […] Even experience is malleable—we know that for many people the same glass of wine tastes better when poured from a $100 bottle than from a $10 bottle.”

This conclusion is more true than we want to admit. So, without further ado, let’s get to the point:

MAGIC NUMBERS (9)

Over fifteen years ago, MIT and the University of Chicago published a paper that, after conducting several experiments, concluded: “use of a $9 price ending increased demand […]”[1]. That’s why hundreds of products available online (and in the brick-and-mortar stores as well, for that matter) end with .99 or .90. Customers tend to perceive these prices as lower, discounted, or simply more attractive than others. Moreover, the same study showed that this effect was stronger concerning new products than those available also in previous years.

ODD/EVEN PRICING

This pricing strategy is closely related to the first one, but while in the first one we concentrated on the rightmost numbers, here we concentrate on the leftmost numbers. You see, when your price is 20 USD, people automatically put it in the twenty range. Making it 19.99 USD, puts this price in the teen range, which psychologically is significantly lower. And it doesn’t really matter that the actual price difference is just 0.01 USD.

The odd pricing strategy is used to set prices under a round number (9.99, 19.97). Even pricing is used to set prices ending in a whole number (0.20, 10.50).

COMPARATIVE PRICING

With this strategy, you show two similar products but at different prices. The first product’s price ought to be much more attractive than the other’s. For example, this strategy is commonly used in the electronics product sector or fashion industry. The two laptops showed side by side with a similar specification but different prices, make customers frequently pick the more expensive (i.e., better) option.

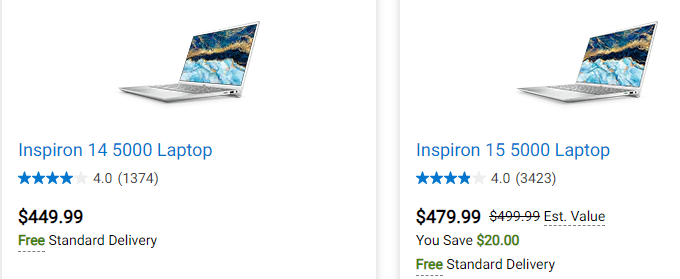

Take a look at this example from Dell.com:

As you can see, Dell uses several pricing strategies here, but let’s focus on comparing the prices of these two laptops. The more expensive one has a bigger screen and more RAM. Which one, in your opinion, more customers will pick? The answer is obvious, and this is what comparative pricing is all about.

ANCHOR PRICING

Online stores use this strategy every time they present discounted products with the original price still visible. Every time you see this: 120 USD now 85.99 USD! The higher, original price is the anchor. Again, it’s all about perception. People tend to assess each price whether it’s fair or not. Such discounts make them feel like they get a better deal.

Sometimes, anchor pricing can relate to two different products. Let’s use our laptop example again. Suppose the only difference between these two computers is the screen size. You can buy a 15″ laptop for 700 USD and a 14″ one for 600 USD. Which one will you pick? Many customers will get the cheaper one. After all, a 1-inch difference is nothing compared to 100 dollars in your pocket, right? In this case, the more expensive computer is the anchor for the cheaper one, which, in comparison, looks like a bargain.

PRICE LINING

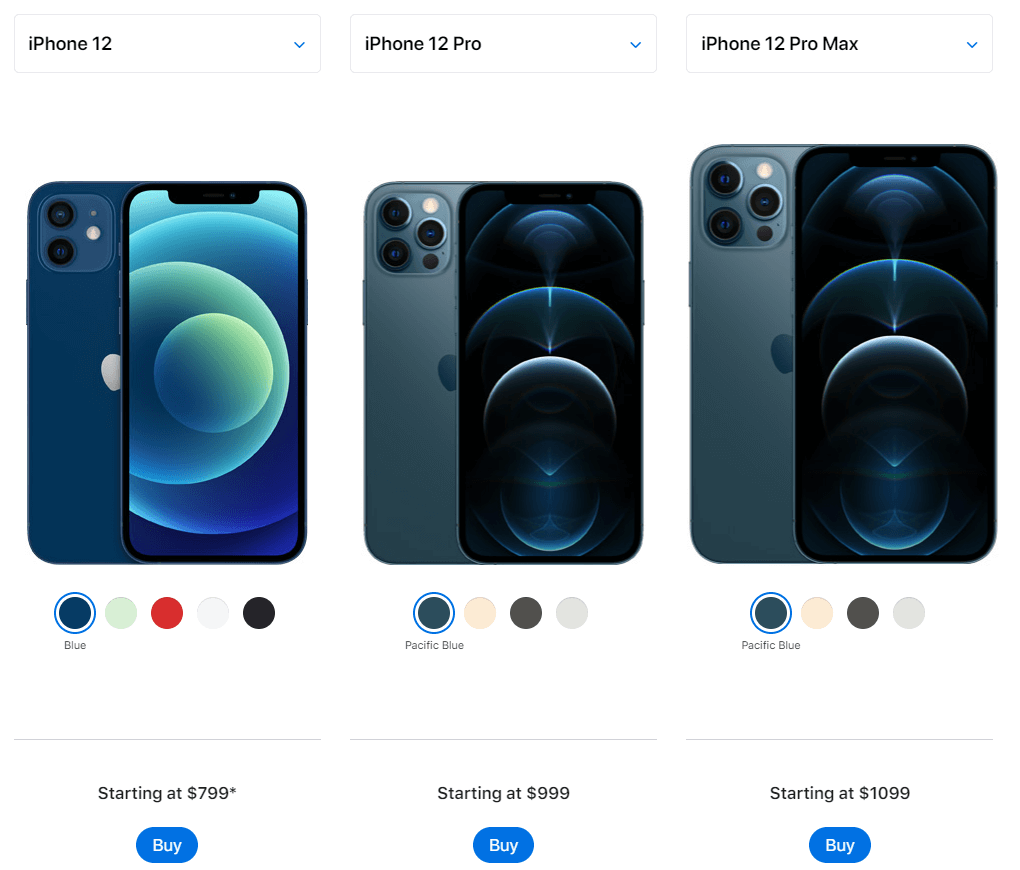

Apple has mastered this practice. In essence, it’s all about offering similar products that are more and more expensive depending on version/configuration. Take a look at the iPhone example:

Do you think that there are any significant differences between these iPhones? That the most expensive option is worth a 300 USD price difference? Not necessarily. But Apple and many other retailers want you to think that the more expensive option is worth purchasing, not the cheapest one. Interestingly, iPhones seem to have the highest % drop of price in half a year from release. To find out more, take a look at our How does Apple use being a luxury brand? case study.

Gas stations use a similar strategy. You can buy regular gas for 2.87 USD, but we also have the Premium version for 3.46 USD. Of course, you want to keep your vehicle in good shape, so you pump the Premium one and pay almost 20% more. That’s how price lining works.

PARTITIONED PRICING

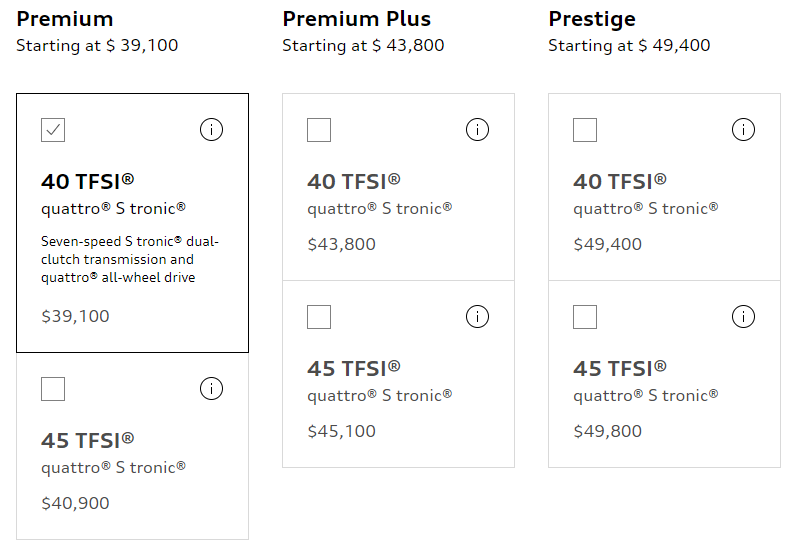

This one is particularly interesting. The main idea behind partitioned pricing is to get customer’s attention. The base price of the product seems attractively low. That’s because the retailers divide the total product price into smaller, easier-to-digest components. As a result, you have a wonderfully low base price and then a ten-mile-long list of options and additional fees. Do you want an example? Luxury car manufacturers. Consider a reasonable Audi A4. According to Audi USA, the starting price is at 39,100 USD. But add a few options, pick the better-equipped version, bigger engine, and the final price can easily exceed 50,000 USD and more:

That’s a textbook example of partitioned pricing. The idea is simple: The initial price is low so that it catches your attention. The rest happens quickly.

BOGOF

Perhaps you’ve never heard this abbreviation. It stands for Buy One, Get One Free. Of course, it doesn’t have to be necessarily in this form. E-commerce companies use diverse versions of this strategy, for instance:

- Buy and get free bonuses

- Buy two, the third one for free

- Buy three and get a 50% discount, and so on

The idea is to create an immediate need to place an order. After all, the benefits are apparent, right? For example, this strategy is commonly used by companies and influencers selling digital products, like online courses or e-books.

How can you verify the efficiency of these pricing strategies?

With price monitoring, of course! At Dealavo, we offer an intelligent online tool that enables you to monitor prices constantly in:

- Your store

- Your competition’s stores

- Marketplaces, price comparison websites and other e-commerce platforms (e.g., Google Shopping)

In order to set and maintain the highest prices possible. This way, you can also assess what results each of these strategies will bring in your case. And if you want to find out what pricing tricks your competition uses, Dealavo’s tool will also come in handy.

Find out more and click this button: