Pricing Strategies: How to Scale and Grow Without Losing Profit (Guide)

- 14 May 2024

E-commerce is a highly competitive sector. Customers have millions of products to choose from. Even a small change in the product’s price can often decide whether you will close the deal or not. Naturally, online stores have many different ways of growing their business, especially the marketing-related ones. But if you want to thrive in this difficult industry, you also need effective e-commerce pricing strategies that will allow you to get ahead of your competition and attract customers looking for good deals. And that’s what we want to discuss in this guide.

Why are e-commerce prices so important?

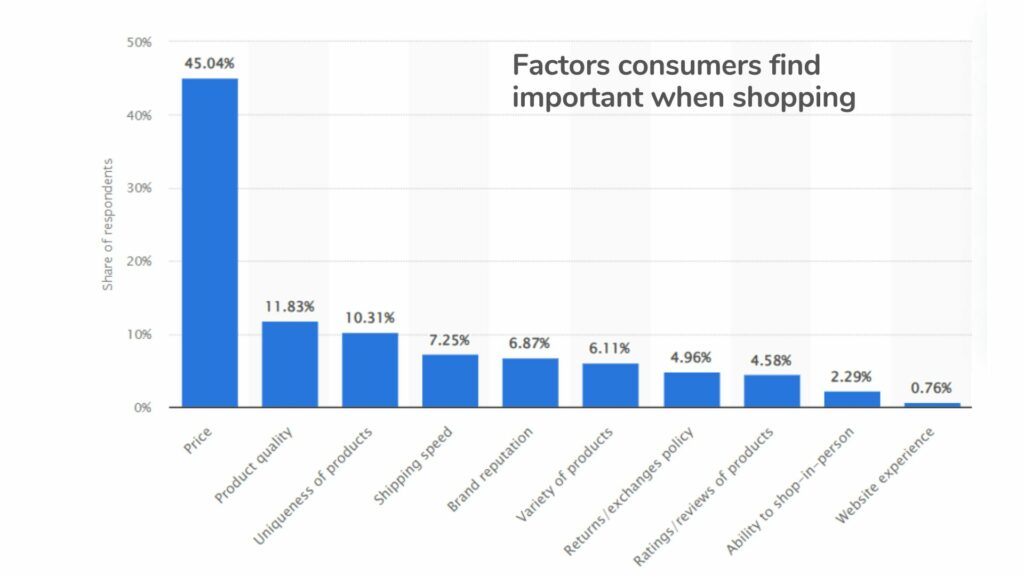

The short answer is that, in most cases, price is the number one factor influencing customers’ shopping decisions. According to studies published by Statista, almost 50% of customers pay attention to the price first. Interestingly, product quality ranks second with just shy of 12% of answers:

You should place your pricing strategy in the main factor of sales, source: hostmerchantservices.com

What is also noteworthy, almost the same percent of respondents (47%) say that too high extra costs are the number-one factor for their cart abandonment:

Card abandonment reasons, source: statista.com

Every e-commerce business owner must understand that we live in very dynamic times where customers are cautious when it comes to spending money. This is true even concerning luxury products. There was another study conducted in the UK in 2019. At that time, price was the second most important factor (68% of answers) slightly surpassed by quality (75% of answers).

The conclusion is obvious – you need good prices in your online store if you want to succeed in today’s market. Thankfully, you have plenty of options in this area! Let’s explore this topic in greater detail.

WHY DO YOU NEED TO PAY CLOSE ATTENTION TO YOUR PRICES?

The fact that the price is an important decision factor is just one thing. Pricing also affects your brand image and positions you in a specific market sector. Here’s an example – imagine Maserati offering their cars for $40,000. Would you retain their image as a premium car brand offering luxury vehicles? Not necessarily, right?

Prices will help you create the desired image of your brand and help you achieve the market positioning you’re aiming for. This is what pricing consultancy as a service is about, read the linked post to learn more.

What Are Pricing Strategies in E-commerce?

In this guide, we’ll discuss 12 different pricing strategies (plus a few strictly for manufacturers). Some of them come in handy only in specific situations (e.g., when you run a luxury brand), and some are more flexible and can be used by almost any online store or brand.

What’s important is for you to understand them and the differences between them because a basic cost-plus pricing strategy doesn’t really work anymore.

Pricing strategies you will discover in this guide:

| Cost-based strategy | Psychological pricing |

| Competitor-based strategy | Bundle pricing |

| Market-based strategy | Price anchoring |

| Loss leader pricing | Price skimming |

| Price discrimination | Dynamic pricing |

| Penetration pricing | Pricing for manufacturers |

| Decoy pricing |

However, before we get to these e-commerce pricing strategies, let’s see what factors you need to consider to ensure you’ve picked the right one.

Factors Affecting Your E-commerce Pricing Strategy

There are five crucial elements you need to consider carefully before selecting a specific e-commerce pricing strategy (also, don’t forget that you can mix them and use more than one strategy in your business):

- Costs: First off, you need to understand all the costs involved in running your e-commerce business. This includes manufacturing products (if you are also a manufacturer), creating and maintaining your website, marketing, shopping, employees, etc. Try to figure out a number that covers all of your business expenses.

- Competitive landscape: It’s always a good idea to analyze your competitors and their prices. Competing on price is not always a good idea and can end up in a price war, leaving you with a minimal (or lack thereof) profit margin.

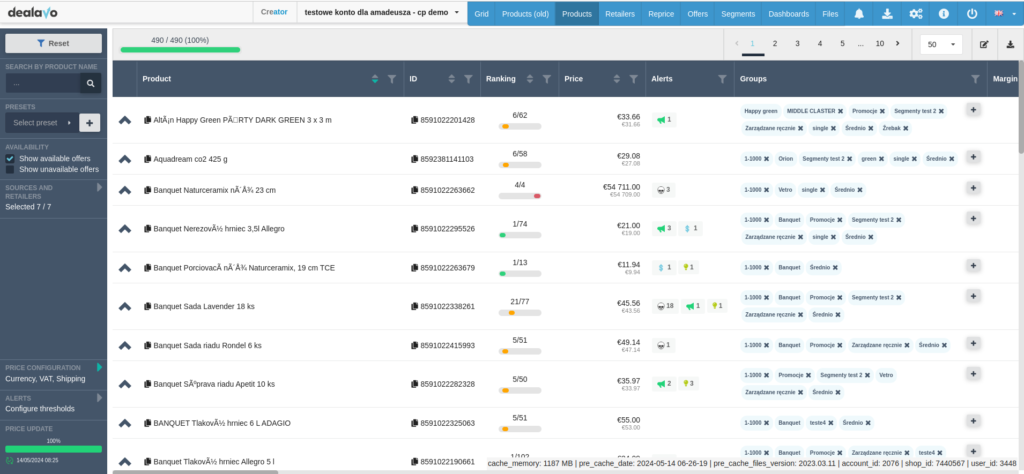

Here at Dealavo, we have many tools for e-commerce business owners, allowing them to get ahead of their competition. Use our price monitoring feature to see what products that you’re selling are offered by your competitors:

- Target audience: You also need to thoroughly understand your target audience. How much are they willing to pay for your products? What prices do they find acceptable? What matters to them when it comes to the type of products you offer? Different audiences are receptive to different pricing policies. Do you think Maserati’s customers wait for discounts at dealerships to buy a Maserati car? At this price point, a several-thousand-dollar discount is not really an incentive.

- Perceived value of your products: What kind of products are you selling? Are they perceived as prestigious? Practical? Valuable? Do people buy them because they need them (e.g., gardening equipment) or because they want to have them or show their status through them? These questions are extremely important because you cannot sell a 5-dollar product for 100 dollars if the perceived value of your product is minimal.

- Market demand: Do people need your products? What are the alternatives they can use? Are they cheaper or more expensive? Do other products offer the same features and functionality as your products? What can make your products stand out from the competition? If you’re selling a common product such as kitchen knives, what will make people pay over $3,250 for them (e.g., William Henry Kultro Pro culinary knives):

The pricing strategy is closely linked to the type of product you offer. Image source: laminedor.com

Finding The Right E-commerce Pricing Strategy for Your Business’ Success

The decision of which pricing strategy to employ for your online store is not an easy one. It can affect not just your profit margin, but also the long-term success of your business. Products that are wrongly priced will not get you many customers.

Remember that about 50% of customers pay their attention to the price first. Only then, they look at other factors. This doesn’t mean that there is no more room for expensive products, but if you want to increase your prices, you need to give your customers a good reason for that.

This guide will help you evaluate various pricing strategies by considering your business profile, customer expectations, and profitability goals. By carefully analyzing the options and comparing them to your needs, you’ll be able to develop a pricing strategy that’s:

- Tailored to your business’ profile

- Attractive (or at least acceptable) to your customers

- Profitable enough to give you a sufficient profit margin at the end of the day

So, without further ado, let’s have a look at your options:

Cost-based Pricing

It’s the most straightforward e-commerce pricing strategy that you can employ, and to be honest, not a very good one in the current market conditions. Cost-based pricing is sometimes referred to as the cost-plus pricing strategy or break-even pricing strategy.

In this strategy, the price of a product or service is determined primarily by the costs incurred in producing, distributing, and selling it. However, a big minus here is that it doesn’t take into consideration any external elements and factors, which can blur your vision.

There are two versions of this strategy:

- Cost-plus pricing: Here, you add your markup to the total cost per product to determine the final price.

- Break-even pricing: In this approach, the price is set to cover all costs and achieve a break-even point, where total revenue equals total costs, which basically means that you don’t make any money selling your products.

This strategy can be extremely helpful as a basis for your overall e-commerce pricing strategy. This means that you can employ it, but it’s not a good idea to make it the ONLY strategy you follow. If you’re interested in cost-based pricing, take a look at this blog post: Cost-plus pricing strategy – definition and usage in e-commerce.

Tips on implementing cost-based pricing strategy in your business:

- Calculate the total cost of your product – add up all costs associated with making and delivering the product.

- Decide on an appropriate markup percentage based on desired profit margins – what percentage of markup is required to achieve a satisfactory profit.

- Set the price – add the markup percentage to the total cost to get the selling price

- Monitor market conditions – periodically review competitor pricing and market demand, adjusting your price if necessary.

Possible challenges:

- ignores customer preferences and market conditions,

- limited flexibility in a competitive market.

Competitor-based pricing

This strategy is sometimes referred to as competitive pricing. It’s one of the more straightforward product pricing methods that’s based on the prices of your competitors. You can use it as long as there are products that are similar to yours in the market.

In practice, it boils down to searching for optimal price points with reference to other products available on the market. The big advantage of this strategy is that you can position your products in line with other products out there. Sometimes, you can go slightly above or below the market average with your product, but at some point, it’s no longer competitor-based pricing.

EXAMPLE OF COMPETITIVE PRICING STRATEGY

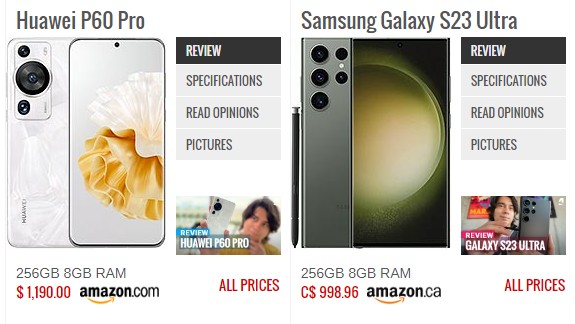

Take a look at this example: Samsung’s and Huawei’s top smartphones are very similarly priced, which may indicate that both companies pay close attention to how priced are other similar products in the market:

Competitive Pricing Strategy example, source: gsmarena.com

Competitor-based pricing will help you remain competitive and attract more customers to your products because you take the price out of the equation and simply “force” customers to compare other elements of your and your competitors’ offers.

Tips on implementing competitor-based pricing strategy in your business:

- Research competitor prices – identify your competitors and their pricing of similar products.

- Analyze market positioning – match, beat, or exceed competitor prices based on your brand positioning.

- Set the price – stay competitive while remembering about your own profit margins

- Track competition – keep an eye on competitors’ pricing to ensure your prices stay relevant.

Possible challenges:

- can lead to a race to the bottom,

- limits differentiation based on value rather than price.

Read more about competitive pricing analysis.

Market-based Pricing

In market-based pricing, you concentrate mostly on determining the optimal price of your products based not only on what your competitors are doing price-wise but also on the overall market situation, including the following elements:

- The demand levels

- Consumer preferences and their purchasing power

- Perceived value of your products

- Other relevant market trends (e.g., boating equipment may be more popular in the areas with access to water bodies – lakes, rivers, seas, etc.

In order to succeed with market-based pricing, you need to conduct a thorough market research to understand what affects your sales and your offer. The final price of the product needs, therefore, to be adjusted to current market conditions.

One of the companies that employ market-based pricing is Apple. They know their target audience and market perfectly, and they use this knowledge to charge premium prices for their products (they also use value-based pricing, discussed later in this text).

The fact is that Apple is frequently ridiculed for their prices, but it doesn’t stop them for making millions of dollars on their products. That’s partly because Apple knows its audience and knows how much their customers are willing to pay.

Market-based pricing strategy, image source: https://youtu.be/LiAzrco8wsk?si=4WVBts1ibPAdQGCA

Tips on implementing market-based pricing strategy in your business:

- Conduct market research – gather data on market demand, consumer preferences, and competitor pricing

- Segment Your Audience – try to identify different customer segments based on purchasing power and behavior.

- Set the price – a price should reflect what the consumers in each segment are willing to pay.

- Track market condition – monitor the market and make the adjustments when necessary.

Possible challenges:

- time-consuming, requires deep market research,

- can be difficult to execute in rapidly shifting markets.

Consumer-based/Value-based Pricing

These strategies are named interchangeably and are pretty much the same. Sometimes, you may even encounter the consumer value-based pricing. This strategy is extremely popular with all the premium brands.

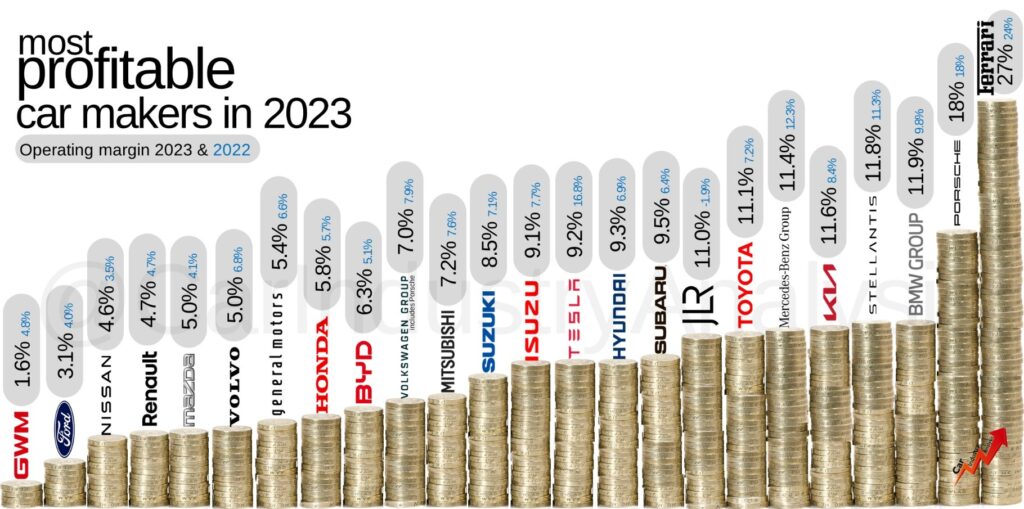

In short, value-based pricing is all about charging as much as people are willing to pay for a given product. Here, Ferrari is a perfect example. Why? Because it is, by far, the most profitable car maker in the world. On average, Ferrari makes 118,000 EUR on each car they sell, which gives them a 27% margin (a 3% increase from 2022):

Product value-based pricing strategy, source: fiatgroupworld.com

To put it in perspective, Mazda has to sell a whopping 98 cars just to get as much profit as Ferrari gets on each car they sell! That’s how value-based pricing works. Customers appreciate everything that Ferrari stands for and are willing to pay a lot of money to get one (or more) of their cars in their garage.

The same is true with other premium brands. For instance, Burberry, another super-premium brand, charges over $2,500 for their famous trench coats:

Premium brands pursue their own pricing strategies, image source: burberry.com

In order to utilize this strategy, you need to have a very strong and luxurious brand that communicates not just quality (you can buy a really nicely made trench coat for less than $2,500) but also legacy and status. That’s the key to this strategy; it’s extremely profitable but not accessible to all brands, at least not at the beginning.

Tips on implementing consumer-based pricing strategy in your business:

- Understand customer perceptions – gauge the perceived value of your product among your target audience (e.g. via surveys, interviews etc.).

- Quantify value – try to reflect the benefits of your products/services in their value.

- Set the price – price your product based on what consumers are willing to pay based on its perceived value.

- Keep on communicating the value – highlight the unique aspects of your products and reinforce their value proposition through proper marketing strategies.

Possible challenges:

- applicable mainly to brands with strong, established value,

- difficult to implement for newer businesses without a clear value proposition.

Read more about value-based pricing.

Loss-leader Pricing

Have you even seen a product that’s so cheap you begin to wonder how they make money selling it? The answer is probably they don’t. Loss leader pricing is based on offering one or several products below profitability just to bring the new traffic to your online store.

When people see a product in your store that’s incredibly attractively priced, they begin to perceive your prices as attractive. They may start putting more products in the cart, and even if they don’t, you still get their email address so that you can use other selling strategies such as cross-selling and upselling.

Loss-leader pricing also works brilliantly if there are other costs involved with the loss-leader product. The simplest example – printers. Sometimes, you can buy your printer for as low as several dozen dollars, but then you need to buy ink cartridges, and they are not cheap at all. In fact, buy them twice or three times, and you’ll pay more than for the actual printer.

So, the company selling the printer can afford to sell you the printer below any profit margin because they earn the money selling cartridges.

There are other examples of loss leaders, too:

- Razors (extremely cheap compared to new blades for them)

- Gaming consoles (four of five games can cost more than the actual console)

- Cell phone plans (you can get a shiny new flagship phone for $1, provided you contribute to a two or three-year cell phone plan that costs you around $80)

Loss-leader pricing can be utilized when you want to bring more new traffic to your store and then encourage those customers to upsell and buy more products in your offer.

Tips on implementing loss-leader pricing strategy in your business:

- Select the product – choose popular product(s) that can attract customers, but keep enough margin on other products to compensate for the loss.

- Determine the discount value – set a discount or price below cost for the selected loss-leader product.

- Promote the Loss Leader – focus on promoting the discounted product heavily to attract as many customers as possible.

- Upsell and cross-sell – the loss-leader product strategy should eventually lead to additional sales of higher-margin items.

Possible challenges:

- can cause short-term losses (you might need a strong and stable profit margin for compensation),

- Works best for businesses with upselling or cross-selling opportunities.

Price discrimination/Differential pricing

This is one of the most intriguing pricing strategies, and we need to be upfront here – not all online stores will be able to implement price discrimination for several reasons. Let’s have a look at what this strategy entails:

The basic premise is that in this strategy, products can be offered at different prices depending on three factors:

- How much customers are willing to pay (so-called first-degree price discrimination)

- How many products they want to buy (second-degree price discrimination)

- What segments they represent (third-degree price discrimination)

Even if this term is not familiar to you, we’re 100% sure you’ve encountered differential pricing multiple times in the past. Here’s how it works:

- First-degree price discrimination: All the internet auctions, such as those hosted on eBay. Customers bid against each other for a specific product, and the person who’s willing to pay the highest price, gets the product.

- Second-degree price discrimination: Costco and other wholesale companies are good examples. One bottle of water will cost you $1.50, but buy 30 of them in bulk, and you will only pay 60 cents per bottle. There are also online stores that work this way, e.g., Alibaba.com.

- Third-degree price discrimination: Are you a student or a senior? Enjoy a 15% discount. That’s a good example of price discrimination; when some customer groups can buy a given product for less only because they represent such a group.

A good example of second-degree price discrimination on Alibaba.com

Penetration Pricing

That’s yet another example of a pricing strategy that’s not for every online store owner, primarily because it requires a large initial investment. Penetration pricing is frequently used with new products: The producer/distributor wants to get as many of these products out there as possible, so they lower the initial price of the product significantly to attract as many potential buyers as possible.

Now, because the product is cheap, people start to buy it. The product becomes popular and more people want to have it, and that’s when the price goes up. This strategy is frequently used as a version of the loss leader pricing. However, here, the goal is to acquire as high market penetration (hence the name) as possible.

EXAMPLE OF PENETRATION PRICING

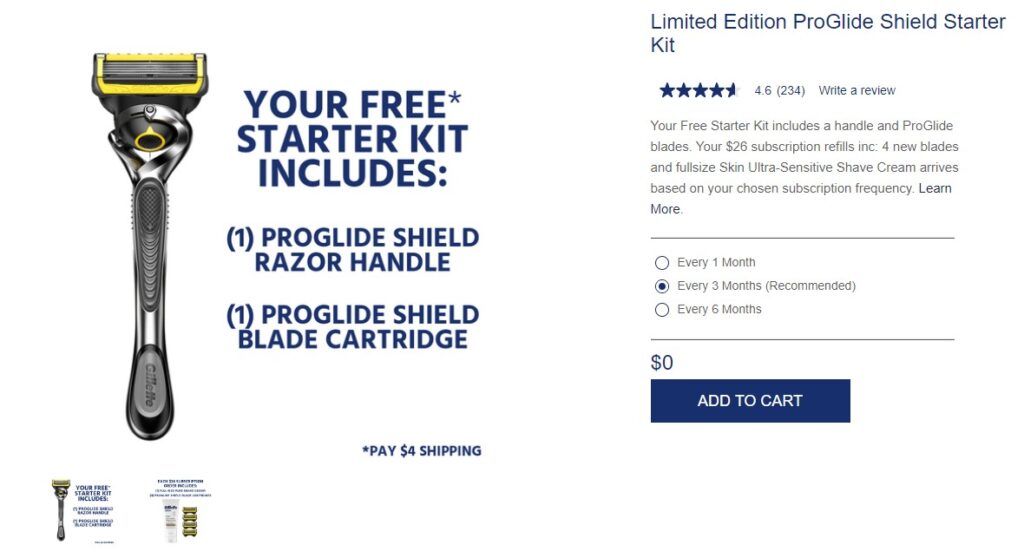

This is something Gillette does. This world-famous company offering shaving products offers their starter kits for free. Yes, customers get a razor handle and a blade cartridge for just a $4 shipping fee. There is only one condition: The customer must agree to a monthly, quarterly or semi-annual subscription.

So, it is clear that Gillette will make up the lost profit, sometimes within two-three months. Plus, they will make more money, because many customers will appreciate the convenience of this solution and stay with them for years.

The only tricky part is that Gillette can afford such a strategy; it’s a large company that makes millions of dollars every year. They can afford to give away a few razor handles for free. Smaller companies usually don’t have enough budget to afford penetration pricing. Plus, you need to be aware that this strategy doesn’t work with every product, you need to have a way to make up for this initially lost profit.

Tips on implementing penetration pricing strategy in your business:

- Set a low initial price – launch the product at a significantly lower price than competitors.

- Market aggressively – you can use discounts, advertisements, or even influencer marketing to increase product’s visibility.

- Monitor customers’ behavior – estimate the success of your penetration pricing strategy by tracking customers’ satisfaction.

- Gradually increase your price – begin slowly increasing your price once the product has gained a stable customer base.

Possible challenges:

- requires significant upfront investment,

- smaller businesses may struggle to maintain low prices long-term.

Decoy Pricing

This pricing strategy is all about pricing your product (A) in such a way that makes another product (B, a slightly more expensive product) seem like a better value by comparison with product A. The idea is to influence consumer behavior by presenting them with choices, suggesting a more expensive option as the better one. Decoy pricing is extremely popular among SaaS companies but you can sometimes see this strategy in action in normal stores and restaurants as well.

Coffee is a very good example of decoy pricing in practice. Take a look at this price list from one of the restaurants:

Decoy pricing strategy, source: gravitypizzacafe.com

In this instance, the difference between the tall and grande cup sizes is, in most cases, just 50 cents, making the grande option look better. This makes the tall size the “decoy” because it influences customers to perceive the grande size as the best value.

Tips on implementing psychological pricing strategy in your business:

- Introduce a third product – add a product that will make other alternatives look more attractive.

- Set the right price – the decoy item should be priced in a way that will make the target item seem like a better choice.

- Don’t overdo – use decoy pricing sparingly and avoid creating confusion with too many options.

- Monitor customers’ response – check if the decoy strategy is leading to higher conversions or greater revenue from specific price points.

Possible challenges:

- may confuse customers if not done correctly,

- requires careful pricing structure.

Psychological Pricing

Decoy pricing and psychological pricing have a lot in common. Both strategies are about presenting the price in a way that seems more attractive to potential customers. With psychological pricing, there are several tactics you can employ to make your prices look better:

- Magic numbers: Here, prices end with .99 or .90. Customers tend to perceive such prices as lower, discounted, or simply more attractive than others.

- Odd/even numbers: The odd pricing strategy is used to set prices under a round number (9.99, 19.97). Even pricing is used to set prices ending in a whole number (0.20, 9.50).

- Comparative pricing: Very similar to decoy pricing, you put two similar products together and make the price of one of them look more attractive to encourage people to buy it.

- Anchor pricing: Works with discounted products. Display a clearly visible previous price along the new/discounted price to tell people how much they’re actually saving on your product.

- Price lining: Display several versions of the same product that are more and more expensive depending on version/configuration. Now the question is not whether you want to buy, but which one.

- Partitioned pricing: This is what car manufacturers do. You start with a cheap base product and then add options to make it better and, hence, more expensive.

- BOGOF: This term stands for buy one, get one free; this strategy is very popular with FMCG products.

EXAMPLES OF PSYCHOLOGICAL PRICING STRATEGIES

Example of price lining on Apple’s website:

Psychological strategies at Apple, source: https://www.apple.com/pl/shop/buy-iphone

Example of comparative pricing and magic numbers on BestBuy.com:

Source: BestBuy.com

Tips on implementing psychological pricing strategy in your business:

- Analyze the market – try to estimate which psychological pricing strategy would be the best regarding your market position and your competitors.

- Choose your psychological pricing strategies – you can use multiple psychological pricing strategies for different products.

- Track the market’s response – monitor your competition’s reactions to your pricing strategies.

- Maintain or change the selected pricing strategies – assess the results of your psychological pricing strategies and adjust them when you find it necessary.

Possible challenges:

- less effective for some premium products,

- overuse can harm consumer trust.

Bundle pricing

Here, you combine two or more different products to create a bundle – a set of products that theoretically should be sold for a bit less than the products that make up the bundle separately (that’s not always the case, though). If you’ve ever seen a shampoo sold paired with a hair conditioner, that’s a good example of bundle pricing.

There are several forms of bundle pricing:

- Mixed bundling: You offer any mix of two or more products that can be sold together (e.g., a tennis racket with a set of tennis balls)

- Pure bundling: You create a set of products that can only be bought in a product bundle (e.g., car floor mats)

- Same-product bundling: You sell several of the same products in bulk (e.g., a six-pack of water bottles)

EXAMPLES OF BUNDLE PRICING

Mixed bundling example: Decathlon sells two tennis rackets with two balls and a tennis bag as one product:

Source: https://www.decathlon.ca/en/p/8585417/tennis-set-duo-2-racquets-2-balls-1-bag

Pure bundling example: Home Depot sells home tool sets featuring over 100 different tools and a case for them:

Source: https://www.homedepot.ca/product/anvil-143-piece-home-tool-set/

Tips on implementing bundle pricing strategy in your business:

- Identify groups of similar products – think of complementary products that make sense to group together.

- Set the price for the bundle – the total price of the bundle should offer a sensible discount or provide some added value to the consumer.

- Track the popularity of your bundles – monitor the customers’ reception of your bundled products and assess the effectiveness of this pricing strategy.

- Offer flexibility – let your customers customize your bundles to cater to their individual preferences and potentially increase sales.

Possible challenges:

- may devalue products if bundles are priced too low,

- requires a strong understanding of consumer demand for bundled items.

Price Anchoring and Price Skimming: What Is The Difference?

We decided to put these two strategies together because both involve setting initial high prices for your products. However, price anchoring focuses on using that high price as a reference point to influence perceptions of subsequent prices. Price skimming, on the other hand, involves initially setting a high price and then gradually lowering it over time.

With price anchoring, if the initial price of the product was $1,000 and now it’s $750 and you keep both prices visible on your website, the lowered price looks like an even better deal. Some stores even specifically tell you how much you save this way. In this example, the previous $1,000 price is the anchor (hence the name).

Price skimming is often used for innovative products where there is initially less competition combined with the demand from early adopters willing to pay a premium price.

AN EXAMPLE OF PRICE SKIMMING AND PRICE ANCHORING IN ONE OFFER

When DVD players were first introduced to the market, they were very expensive. Today, because this technology is basically outdated, you can buy them for as low as $42.

Source: Amazon.com

Tips on implementing price anchoring strategy in your business:

- Set a high price – display a higher initial price or an inflated reference price for comparison.

- Offer a discount – offer a lower price that makes the product seem more affordable in comparison to the anchor

- Monitor your customers’ response – the final price must not mislead customers about the actual value of the product.

- Leverage price anchoring in a long run – once you discover the sweet spot, use it effectively in sales, promotions, or advertising campaigns to influence consumer perception.

Tips on implementing price skimming strategy in your business:

- Set a high price – the price should reflect the product’s novelty and/or luxury.

- Reduce the price gradually – gradually reduce the price to attract different customer segments over time.

- Protect the high status of the product – make sure the initial high price is in line with how customers perceive the product’s value (even when you start lowering its price).

- Watch out for the competition – be cautious and track the competitors who may quickly enter the market with lower-priced alternatives.

Possible challenges:

- both strategies require knowledge in terms of marketing psychology,

- not suitable for all products or industries (e.g. putting a high discount on a premium product may damage its “premium status”).

Dynamic Pricing: The Most Advanced E-commerce Pricing Strategy Out There

Dynamic pricing is one of the most advanced pricing strategies out there, and we’ve actually created a separate guide dedicated just to this e-commerce pricing strategy. If you’re interested in the details of dynamic pricing, we invite you to read the linked guide.

In short, dynamic pricing is a real-time, AI-based, automated pricing strategy that’s based on analyzing the market situation and your competitors’ offers in order to come up with the optimal prices for your products. Let’s have a look at this example:

Take a look at the BuyTV’s offer. In the initial situation (the upper table), this store’s offer is the most expensive one – there are four cheaper competitors; it’s not a very good place to be, right? Likely, the majority of customers will go with one of the cheaper options, especially when it comes to customers who filter products from the lowest price. In such a scenario, many customers will probably not even see the BuyTV’s listing!

In the lower table, we see what happens when this store lowers the price by just 2.01 EUR. Now, they are in the first position and, most likely, will soon sell more TVs thanks to better exposure. As you can see, the price difference between the lowest and the highest offer was marginal; with such an expensive product, the store can easily lower the price by 2.01 EUR without losing a lot of their earnings. And they can actually make more money because of the better visibility of their offer. It’s better to sell 10 TVs for a price lowered by 2 EUR than one or even zero TVs for a price 2 EUR higher, correct?

To implement such a strategy in your store, you need a dynamic pricing tool that will do that for you. Dynamic pricing is almost impossible to implement manually, so to do it effectively, businesses should invest in price-monitoring tools like Dealavo, which allows for swift and accurate price adjustments in line with market trends. We offer a Dynamic Pricing feature that automatically analyzes competitor prices and market conditions, allowing you to optimize your e-commerce pricing strategy in real time. By adjusting your prices regularly and strategically, you can stay competitive without manual intervention.

How is Dynamic Pricing implemented in an e-commerce business:

- First, you’ll need a proper pricing automation tool (like Dealavo).

- You use the tool’s interface to set your pricing rules and customise price alerts.

- You monitor your profit margin and optimize your pricing strategy by adjusting and customizing your pricing rules on the run, whenever the need arises.

Are there any drawbacks of Dynamic Pricing for e-commerce?

In fact, Dynamic Pricing is a complex system. Without the right technology, dynamic pricing can be difficult to manage manually. However, with the right pricing solutions for e-commerce, like price monitoring and competition tracking software, Dealavo, implementation of Dynamic Pricing and its functioning should cause you no problems.

Moreover, Dealavo’s Customer Success Team is always there for you, should you need any assistance with the system integration or encounter some technical difficulties. Our individual Customer Success Managers will take care of any request and are always ready to share their expert knowledge with our customers.

We invite you to book a free demo of our platform so that you can see how it can help you increase the profitability of your online business!

E-commerce Pricing Strategies for Manufacturers

To make this guide complete, we’d like to show you a few strategies that you can utilize if you are a manufacturer of the products you sell:

- Chase strategy: As the name suggests, this strategy focuses on chasing market trends, especially demand. When the market demand is high, the production level (and product availability with it) goes up, and when customers’ interest drops (e.g., during winter) – the production also level decreases. All Christmas-related products are manufactured based on the chase strategy.

- Make-to-stock strategy: This strategy is good for manufacturers operating in stable market sectors where the demand is pretty much the same during the year. T-shirts are a good example of a type of product where this kind of strategy cold be beneficial. When you follow this strategy, you produce as many products as required to keep warehouses and stores full, thus allowing short delivery times.

- Make-to-order strategy: This strategy is good for niche-product manufacturers. You can adopt it if you produce custom-made products that are offered to specific customers who are willing to wait for the delivery. The make-to-order strategy allows you to offer higher prices compared to other strategies because each product is unique in a way. Cars are frequently sold according to this strategy, especially when it comes to customers who want to pick all the customizable elements like the interior, color, or accessories.

- Assemble-to-order: This strategy is similar to the make-to-order one; the only difference is that here, you hold all the components necessary to produce products in your inventory, but you do not start the actual production process without an order from a customer. For instance, this strategy works well with the furniture industry.

- Level production strategy: The last strategy that we want to discuss allows you to work effectively in a cyclic market demand. In other words, you produce a stable amount of products per week, month, or year regardless of other market factors. With this strategy, it’s easier to maintain a fixed product price and avoid unpredicted fluctuations in prices. For example, construction materials can be manufactured using this strategy.

How Combining Different E-commerce Pricing Strategies Helps Boost Business

You probably noticed that many of the e-commerce pricing strategies we mention in this guide overlap or are similar, and that’s true. Pricing strategy is not an exact science, and you can follow different strategies that lead to your ultimate goal: More sales.

We recommend analyzing different strategies and creating a mixed one that works in your case. You don’t need to follow or limit yourself to just one strategy. You can use many and mix them between products, markets, and categories.

However, if you truly want to ensure that your prices are always optimal, we recommend looking into dynamic pricing as the best alternative to any manually-set pricing strategies. With dynamic pricing, you can set some predefined rules and let AI do the rest, ensuring your prices are always optimized to the current market conditions and your business profile.Would you like to know more? Take a look at our dynamic pricing offer and start with a free demo today!